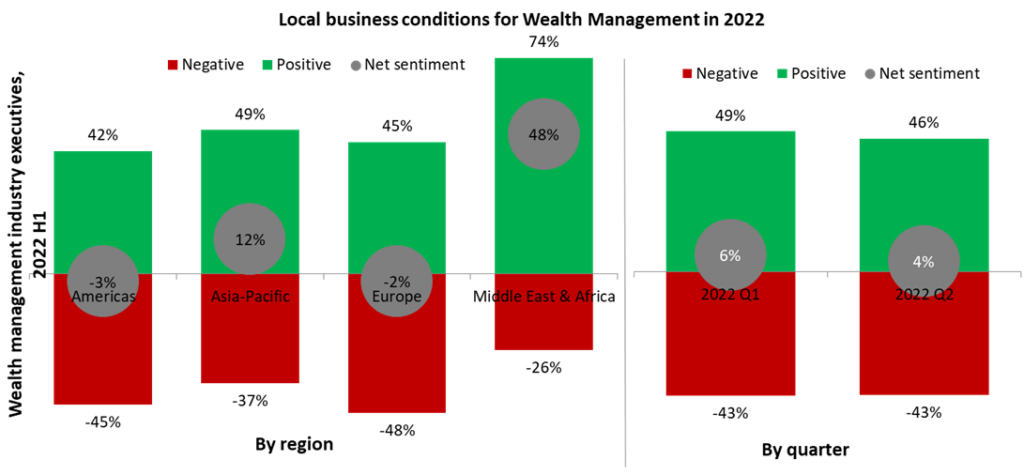

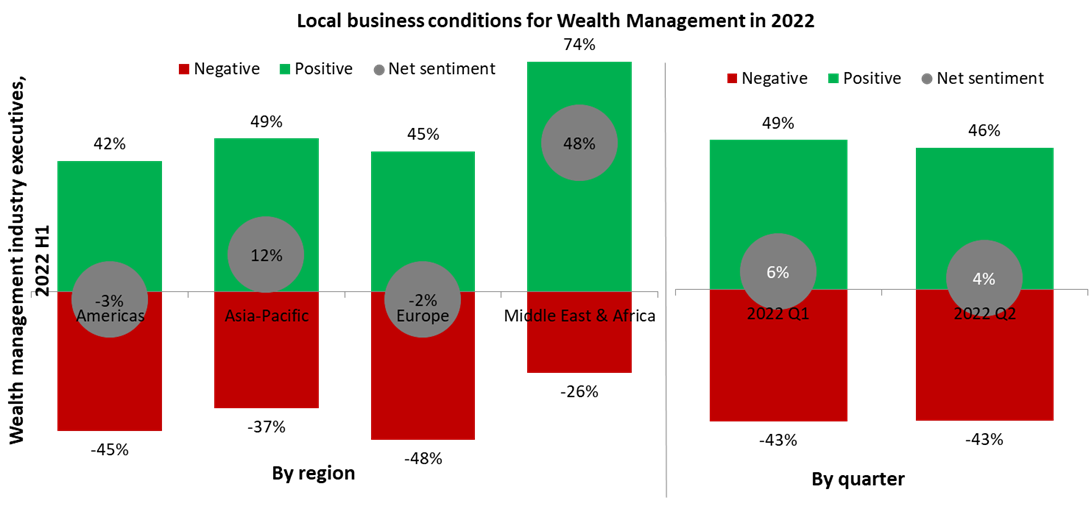

The macroeconomic conditions for 2022 have proven to be more volatile than most anticipated at the start of the year. Much of the hoped-for ‘reopening’ bounce has fizzled due to inflation and tighter monetary policy, severely amplified by the war in Ukraine. Despite these dark clouds, the wealth industry is still hoping for a better 2022. Even in Q2 2022, 46% of industry execs felt local business conditions for wealth management in 2022 would still be better than 2021, narrowly outnumbering the pessimists at 43%.

Core wealth markets in Europe and the Americas have the most negative sentiment

At a top level, this looks like an upbeat assessment of the sector, with only a minor loss of confidence due to the outbreak of war in Ukraine. However, it obscures real danger signals, and this becomes apparent with a regional lens. European and American wealth managers, accounting for 66% of global household wealth in 2021 according to our Wealth Markets Analytics, both have a net negative reading on their assessment of the wealth market business conditions.

Offshore private bankers will be the primary winners

Asia-Pacific wealth managers can take some comfort from the positive 12% net sentiment in the region, but it is the Middle East and Africa (MEA) where local wealth managers are most optimistic about local wealth market conditions. A net positive reading of 74% puts it starkly at odds with Western markets. High oil and gas prices, feeding through into the economies of all oil exporters, are no doubt boosting sentiment in key regional financial hubs such as Dubai that dominate our poll.

However, it should be noted that the region is also highly exposed to the inflation generated by the war in Ukraine, making it harder for consumers to save. Many of the key export markets for Ukrainian and Russian agricultural goods lie in the MEA region.

Where is the optimism coming from then? To answer, one only need look at the offshore market. GlobalData’s 2022 Financial Services Consumer Survey tracked a sharp increase in the rate of offshore investing in every region of the world, and the financial hubs of MEA appear to be one of the key destinations. For example, the statistics of Dubai Financial Markets published in its Q1 2022 Investor Relations Presentation clearly show a marked rise in foreign ownership, up to 23% of the market cap in Q1 2022 compared to just 16% in 2013.

The MEA region has traditionally provided the world’s offshore markets with ample capital for investment. And that is still the case: our 2022 Financial Services Consumer Survey has 37% of the region’s investors holding offshore investments, well above the global average. However, it is now increasingly seen as hosting attractive booking centres as well.

Industry view: Local business conditions for wealth management in 2022 compared to 2021