As one of the biggest countries in the world, there is plenty of wealth in Brazil. As a result, there are many wealth management firms willing to serve that segment. However, how can firms differentiate? The digital realm has become a deciding factor. Patrick Brusnahan writes

According to Knight Frank, there are 4,812 UHNWIs (wealth over $30m) in Brazil.

In addition, GlobalData states there are 99,731 HNWIs in the country. Of this number, 13.2% of them are 40 years old and under, compared to 11.8% across Latin America and the global average of 5.7%. This shows that there is a fair amount of emerging wealth coming from younger clients.

The largest age segment was between 61 and 70 years old with 28.3% of HNWIs falling in this bracket. While over double the amount of under-40s, the gap is shorter than average. Across the world, the 61 to 70 year olds beat the under-40s nearly sixfold.

Sao Paolo is the city with the largest number of HNWIs in Brazil with 18.4% of the total, followed by Rio de Janeiro and 5.8%.

With a large amount of wealth in the country, how are private banks serving these members of the population?

Servicing the wealthy in Brazil

Itaú saw net income of BRL28.36bn ($5.49bn) in 2019, a 10% rise from the BRL25.73bn reported in 2018.

In terms of revenue, Itaú saw BRL119.8bn in 2019, compared to BRL111.8bn in the previous year.

Q4 2019 also improved year-on-year with net income of BRL7.3bn, up 13% from BRL6.5bn in Q4 2018. Furthermore, revenue lifted from BRL17.4bn to BRL19.4bn in the same time period.

Assets under administration (AuA) in Q4 2019 totalled BRL1,387bn, up from BRL1,131bn year-on-year.

Where does Itaú see itself in the market? Right at the top.

Speaking to PBI, Luiz Severiano Ribeiro, global head of Itaú Private Bank, says: “Itaú is the leader in private banking in Brazil, with more than $125bn of assets under custody globally and above 30% share of the domestic market. We believe that for our business to be truly sustainable, our relationships with clients must exemplify trust, ethics and transparency. We offer our clients tailored solutions that are aligned with their individual needs and expectations and supported by a comprehensive global platform of products and services.

“Along with Itaú’s broad institutional structure, our clients are directly served by more than 700 highly qualified, dedicated professionals in our platforms in Brazil, the United States, Switzerland, Latin America (non-Brazil) and the Caribbean.

“In 2019, we posted a record $10 billion in net new asset inflows and record-high client satisfaction numbers.”

Bradesco reported a book net income of BRL22.6bn in 2019. It also holds $1.4trn in total assets and itself in high regard when it comes to private banking.

Augusto Miranda, global head of Bradesco Private Bank, tells PBI: “Bradesco has been in the financial market for 77 years building solid relationships with its clients. Consolidated for 19 years in the market, Bradesco Private is one of the biggest banks in Brazil.

“We have a close relationship with our clients and in order to be even closer we started operating in synergy with the Investment Bank BBI that won for the fourth consecutive year in 2019 The Bankers award for ‘the most innovative bank in Latin America’.

“Furthermore, to ensure that we can serve clients through the whole country we have 14 offices distributed throughout the main states. We also acknowledge that clients nowadays have a bigger portion of their assets abroad and we are heading the same direction with a project of international expansion in USA in addition to the offices we have in the Caymans and Luxembourg.”

A carnival of clients

How does Brazil’s market differ from others? There is certainly a wide variety of customers available to provide banks.

In terms of the market, Miranda says: “Different from the past, Brazil today has the lowest interest rate in history due to the government’s continued fiscal effort to anchor inflation close to the target. Although Brazilian inflation is in line with our peers, the real interest rate still has room to converge to the average for emerging markets, which suggests an opportunity for fixed income assets.

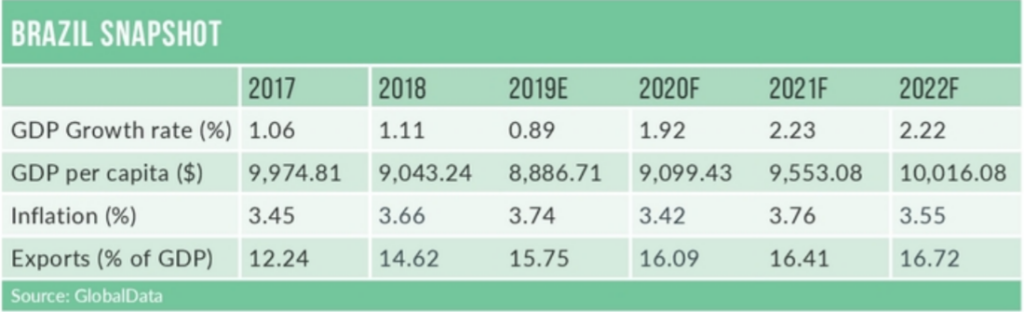

“After some years of recession, Brazilian companies have equalised their balance sheets, adjusted costs and have been able to generate profits between 12% and 15% on average in 2019, even with a modest GDP growth of 1.1%. Consequently, equities have become attractive and we have observed high migration to these investments in recent years, which has stimulated IPO and follow on markets.”

Ribeiro adds: “Historically, the Brazilian market had very high nominal and real interest rates which resulted in client asset allocation very tilted to money market products. This has changed dramatically over the last two years and client asset allocations have been migrating to riskier assets as equities, inflation linked bonds, real estate and other alternative investments.”

He describes the bank’s client base as “broadly representative” of the HNWI population in Brazil. However, it clusters clients in numerous groups outside of asset size including “age, hobbies, expenditure habits, and how digital and technical they are”.

In terms of what the Itaú customer base is interested in, he explains: “In this new context of low interest rates in Brazil, clients are pursuing more sophisticated investment alternatives, and we expect to continue to see rapid growth in the hedge-fund industry, in alternative products and in international investments.

“At Itaú Private Bank we have been preparing for this structural change for several years, working to enhance the sophistication of our products and services and strengthening our international platforms so that we can continue to offer a comprehensive global platform to our clients.”

At Bradesco, Miranda says: “We segment our clients according to the AuM they have in the bank. The majority of our client base is made up of young people, entrepreneurs, heirs and an increase in self-made women, and we offer experiences and events that are customized according to their profile.”

They have particularly been interested in fixed income as it has proven to be profitable in the past. Furthermore, with the new scenario of low interest rates, investors have been looking for better returns in products such as equities and hedge funds.

Technology and the digital touch

Private banking is founded on relationships. Human interaction and relationships are key. However, technology is being increasingly utilised by firms. While this may look counterintuitive to the business proposal, clients are liking it in brazil.

Riberio says: “Listening to our clients, we heard that most of them want to take advantage of new tools and digital channels. Generally, clients like to use digital channels for “commodity-like” tasks such as payments and credit card related activities. But when markets are volatile, when more strategic decisions need to be taken, clients really appreciate live meetings and calls with our teams.”

Bradesco has had a huge digital initiative in recent years and prides itself on embracing technology.

According to its 2019 report, Bradesco has 11.8 billion transactions via digital channels in the year. This is even considering its substantial physical footprint of 4,478 branches.

In addition, there have been 269 million transactions with its artificial intelligence platform and it invests BRL2bn annually in innovation.

“Currently, technology plays an important role in our client’s life in and out of the bank,” Miranda concludes.

“Bradesco Private Bank has a huge technological projects unifying all clients’ information on a single screen. Therefore, the banker will have a 360 degree and integrated view of any client, an efficient CRM and agility in the processes.”