Overview of Robo-Advice for Sophisticated Technology

Demand from investors for automated or robo investment services has been on the rise globally. But to fully infiltrate the HNW space, greater sophistication is needed.

There is no question about it – automated investment services are revolutionising the investment landscape, and demand is no longer only limited to the retail space. 56% of wealth managers targeting HNW investors expect to lose market share to automated investment services in the next 12 months, while only 17% do not. However, to ensure customer stickiness and make real inroads into the HNW space, more than a couple of exchange-traded funds (ETFs) and portfolio rebalancing are needed.

GlobalData’s 2020 Global Wealth Managers Survey found that one fifth of HNW onshore assets are kept in execution-only accounts, and penetration of such accounts is likely to be almost universal across the investor base. While the sophistication of automated investment services is on the rise, they predominately rely on basic risk assessments to assign users to a portfolio consisting of a number of ETFs. The proportion assigned to each is then automatically rebalanced when securities change in value to bring a user’s portfolio back to a specified allocation.

This means investors are essentially paying for a more sophisticated digital interface and automatic rebalancing, given that access to ETFs through an old school online trading platform only requires a one-off fee in most instances, and that ETF annual expense ratios do not vary depending on the channel.

Admittedly, robo-advice fees tend to be low, with most providers charging a flat fee of 0.2% to 0.5% of assets under management. Yet in the absence of more sophisticated features, access to basic ETFs and automatic portfolio rebalancing are unlikely to convince HNW investors to channel substantial sums into an algorithm, when they can just as easily gain access via a trading platform.

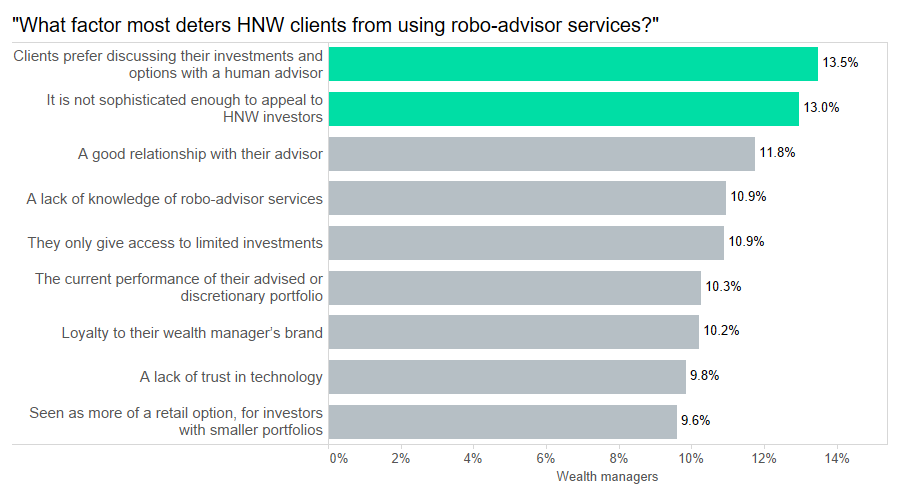

Indeed, a desire to discuss investments with a human adviser and a belief that robo-advice technology is not sophisticated enough are the single most important deterrents to uptake in the HNW space as per our survey data.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataWe have already seen an increased focus on the human component in the robo-advice space. For example, Fidelity, Vanguard, and Personal Capital all offer hybrid services, leveraging technology while also providing access to a human advisor. However, to gain a solid foothold in the HNW space providers will have to up their game in terms of the features they offer. This could include tax loss harvesting and reporting functions as well as greater visualisation and investment access, including non-traditional products such as alternatives.