The fear-of-inflation-induced share market correction, combined with slim fixed-income returns – also worn down by rising inflation – mean wealth managers and their clients are more inclined to explore the alternative investment universe. This means the growth of private equity.

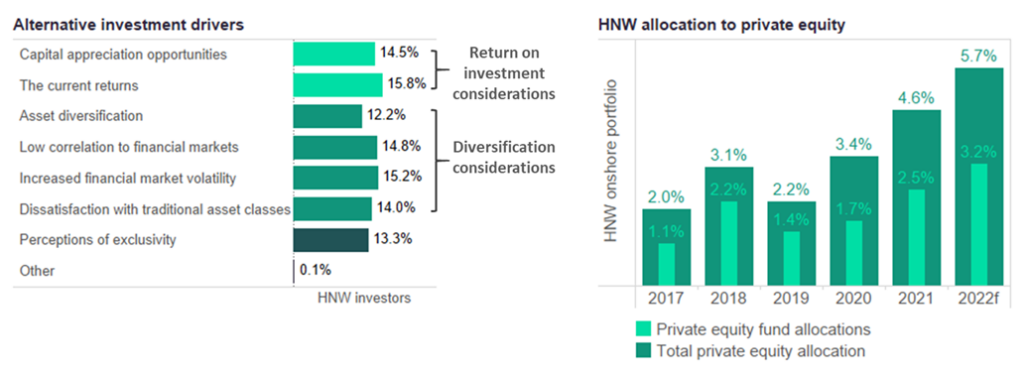

Return on investment-related considerations drive almost a third of HNW alternative investments, while dissatisfaction with traditional investments is responsible for another 14%. However, at 40%, diversification amidst ongoing market volatility is the number one driver and will support already heighted demand for private investments.

COVID-19-induced market upheaval prompted the proportion of HNW wealth allocated to alternatives to rise to 12.6% in 2021. In 2022, we forecast this proportion to reach 14.6%. Meanwhile, the proportion of private equity investments is forecast to rise from 4.6% to 5.7% during the same period as investors are looking for long-term assets less exposed to short-term fluctuations.

Technology will further aid growth, providing access to a broader target market. Predominately designed for institutional capital, private markets are no longer the reserve of the ultra-high net worth (UHNW) segment. Data from our 2021 UK Financial Advisors Survey shows that 25% of respondents regard greater availability and affordability than in the past as the main drivers for private alternatives (the only driver more important is diversification purposes with 30%).

In particular, usage of blockchain is overcoming the hurdles normally associated with private market investments. Traditionally, distributors only have a handful of clients, making record-keeping and liaising between the different parties involved less of a challenge. With potentially thousands of clients involved, the value of blockchain lies in its secure digital record-keeping ability, whereby an audit trail is produced with an always accurate ledger.

With both supply-side and demand-side factors supporting private equity growth, we expect 2022 to be another bumper year for the sector – and a crucial asset class for advisers to be offering to their HNW investors.