COVID-19 is causing increased churn rates in the UK’s wealth market. Almost a third of providers believe that client loyalty to their wealth manager’s brand decreased after the start of the coronavirus pandemic. Large wealth managers in particular need to prioritise fostering client attachment or risk seeing churn rates skyrocket. UK wealth managers must start working on brand.

COVID-19-induced market turbulence is having a significant effect on the UK’s wealth market. GlobalData‘s 2020 UK Financial Advisors Survey found that 13.8% of financial advisers listed the impact of the pandemic as the principle threat to their business, making it the top concern among wealth managers in the UK. In addition, survey data shows that more than two thirds of UK private wealth managers (those serving the HNW) agree that the pandemic and resulting market turbulence are having a negative effect on client retention rates (while only 21.2% disagree).

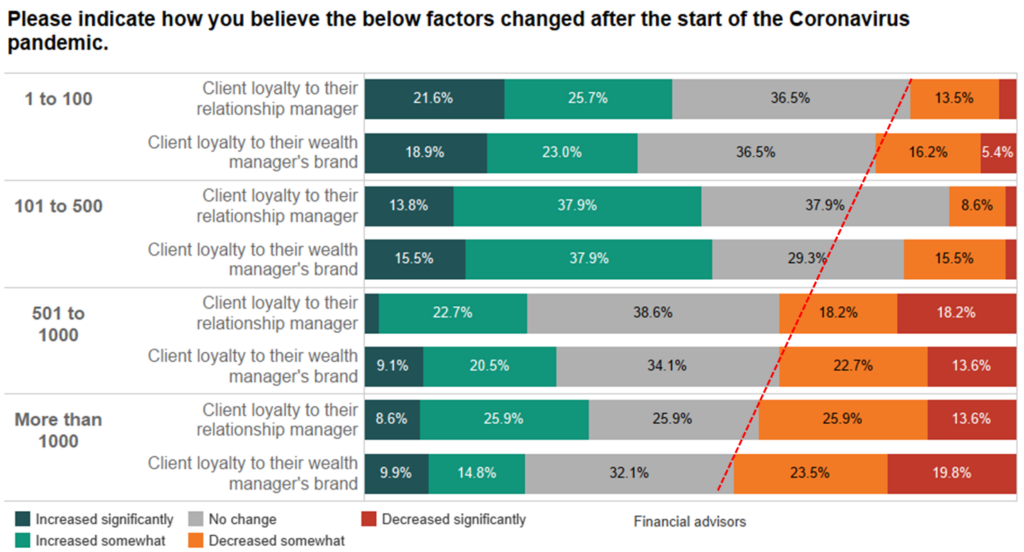

Increased market volatility and resulting portfolio losses can have a major impact on loyalty. However, data from our 2020 UK Financial Advisors Survey shows that the picture is varied, with larger players disproportionately negatively affected. The proportion of wealth managers reporting decreasing client loyalty jumps from 16.2% among players with fewer than 100 clients to 43.3% among those with more than 1,000 clients. Given the more pronounced economic and financial impacts of COVID-19 on smaller players due to their lack of economies of scale, this is welcome news for this segment.

We also see strong differences with regards to consumers’ perception of and loyalty to their wealth manager’s brand versus their financial adviser. Regardless of company size, the negative impacts of COVID-19 on loyalty were more pronounced on a wealth manager’s brand than on clients’ relationships with their advisers.

Wealth managers need to be aware of the increasingly commoditised nature of the advice market, making personals relationships more important. This means consumers are more likely to have attachment to an adviser rather than a wealth manager’s brand – and should an adviser move on, they are likely to take their clients with them. To minimise this risk, firms should pay greater attention to brand management and seek to bind investors to their brand rather than just an adviser, especially as churn rates are creeping up again.