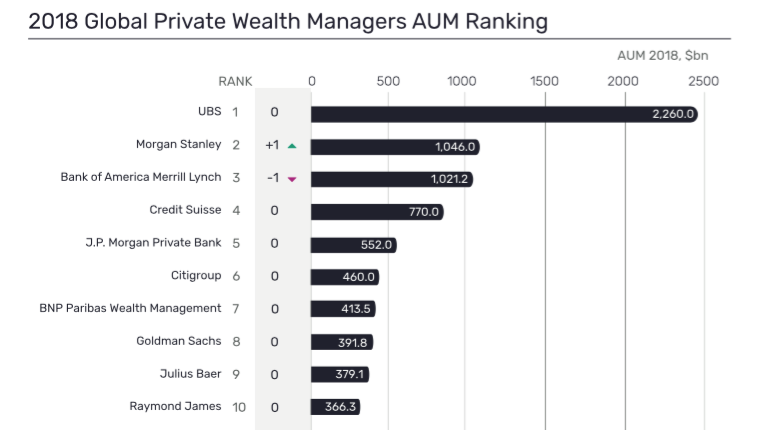

Ranking of the Top Private Wealth Managers by AUM

Private Banker International has joined forces with GlobalData to produce its second annual Global Private Wealth Managers AUM Ranking.

The top 25 global private banks have seen a decrease in their assets under management (AuM) by 1%, according to the latest research by GlobalData and Private Banker International.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

When PBI last conducted the study one year ago, AuM had grown by 14% over the 12 months to May 2017. However, this year’s results show a turnaround in the fortunes of the world’s largest private banks.

When PBI last conducted the study one year ago, AuM had grown by 14% over the 12 months to May 2017. However, this year’s results show a turnaround in the fortunes of the world’s largest private banks.

“AuM is down among the world’s largest private wealth managers despite continued net inflows,” says Andrew Haslip, head of content for Asia Pacific at GlobalData Financial.

The Top Three Private Banks…

- UBS

Once again, UBS holds the number one position in the Global Private Wealth Managers AuM ranking. This is despite its global AuM declining by 6%.

“UBS continued to tower over its closest rivals, despite a reduction in its wealth management division’s AuM”, comments Sergel Woldemichael, a wealth management analyst at GlobalData.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Equally important, it managed to increase revenue despite a lower base and kept growing its profit in what was a challenging year.”

- Morgan Stanley

Morgan Stanley wins its major rivalry over Bank of America (BoA), coming second in this year’s ranking. However, this lead was more down to BoA’s 6% fall in AuM than Morgan Stanley’s increase.

- Bank of America

The rivalry between America’s two wealth management giants is not over, however, with ‘just’ $25 billion between the assets they manage. By comparison, UBS manages more than both Morgan Stanley and BoA put together.

Versus the rest…

Data from the Global Private Wealth Managers study shows that the top five global private banks saw their collective AuM decrease by 3%, whereas the rest in the ranking grew theirs by 2%.

This is a reversal of last year’s study where the top five competitors increased their AuM faster than the rest.

Some of those catching up on the top five include Raymond James, which grew its AuM by 24% in one year. Bank of China pushed its AuM up by 17%, allowing it to move up five places and overtake its rival ICBC in the rankings.

Bank of China represents something of a catch-up among the Asian private banks. Currently none of the top five players are Asian and, in fact, there are only five Asian firms on the entire ranking.

“The benefits of a geographically diversified wealth management business were also apparent in 2018 as the US majors generally struggled while Asia banks were still seeing strong growth,” says Haslip.

In next year’s AuM ranking

Should the top five private banks AuM fall faster than the rest, next year’s ranking is likely to be flatter, with smaller players increasing managed assets at the expense of larger firms.

However, geopolitics could play an increased role, says Haslip: “Given the uncertainty spreading around the world in 2019, geography is likely to be less of a shield, with all wealth managers needing to work harder at attracting new inflows and investing defensively.”

As client assets become tougher to win, rivalries between the top 25 private banks will become less important. All eyes will be on who sees a significant increase of their assets under management in years ahead.