Family offices are not only driving growth in ESG investing – they are also developing bespoke processes for measuring the success of these investments, finds Paul Golden.

Various surveys have highlighted the extent to which family offices are taking a greater interest in environmental, social and governance issues.

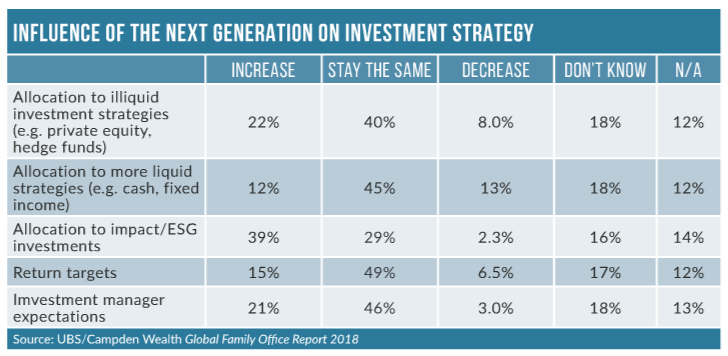

Almost four in 10 (39%) of respondents to the 2018 UBS Global Family Office Report said the next generation planned to increase their allocations to impact/ESG investing, while the latest SIF Foundation report on sustainable, responsible and impact investing trends found that US families increased their ESG asset allocation by 71% between 2016 and 2018.

Holly Isdale, founder of family office advisory Wealth Haven observes that while each family will have different core values and investment policy guidelines, these guidelines will usually have some targeted return expectations – either returns at or above the market for similar non-ESG investments or a spread by which it can underperform.

Holly Isdale, founder of family office advisory Wealth Haven observes that while each family will have different core values and investment policy guidelines, these guidelines will usually have some targeted return expectations – either returns at or above the market for similar non-ESG investments or a spread by which it can underperform.

“Most clients are of the view that ESG needs to meet market returns and should generate higher returns over a longer time horizon, which is reflected in the investment guidelines,” she explains. “If the investment is going to underperform, we turn to ‘asset location’ and perhaps fund it within the foundation as a mission-related investment if that is feasible.”

A client family may hold certain themes as more important, which helps determine the nature of the investment (for instance, socially oriented versus environmentally focused), but strong governance is a must in all cases observes Richard Zimmerman a relationship manager at WE Family Offices.

“The values-aligned investing process begins with understanding the investor’s objectives and unique preferences,” he says. “A diagnostic determines areas of interest or disinterest for each family, which can be a dynamic process as they identify, prioritise and incorporate these areas of importance into the mission of the family wealth enterprise as well as the investment portfolio.”

How Family Offices measure ESG

Though there are many areas where family offices and other private banks or wealth managers might differ in their approach to ESG investments, the measuring these investments is one of the key areas.

While all investors might adhere the UN PRI (Principles for Responsible Investment) and MSCI ratings as screening tools, family offices often develop their own internal rating system.

“Aside from the generic factors of profitability and growth, we look for opportunities run by investment managers who see responsible investing as a fiduciary duty for their strategies, rather than simply using it as a headliner to market themselves,” explains Joe Lin, director of investments at Singapore-based Golden Equator Wealth.

“This will be evident in their understanding of the scope and impact of various issues and the assessment of risks these issues pose to long term sustainability of ecosystems as well as whether constantly emerging research helps hone their insights to make informed and well-calculated decisions,” he adds.

Lin says that by augmenting existing research with its own ESG analysis to measure intrinsic value and potential for growth, Golden Equator Wealth combines traditional quantitative metrics with more qualitative ESG-oriented measurements to holistically gauge success and returns, bearing in mind the far-reaching benefits of such investments versus just accounting for alpha.

“Measurement in ESG and impact investing is both quantitative and qualitative and we have found that there are many approaches yet no perfect solution,” says Zimmerman. “However, measurement is rapidly improving due to data, technology and industry frameworks. We have developed our own methodology to track and report ESG impact performance, which continues to evolve. In general, we prefer to report on the intentionality and impact of an ESG/impact investment using more qualitative measures as we have found that anecdotes and stories resonate more with our client families.”

Stonehage Fleming, a London-based multi family office, says that it has developed its own impact metrics. These include three for the environmental side, six for social and three for governance, says its director of investment strategy & research, Mona Shah. Each of these are tracked quarterly.

According to Gino Perrina, chief investment officer at Laird Norton Wealth Management, setting expectations is critical. “With some funds, where the goal is simply to filter investments by standard measures it is pretty straightforward,” she says. “While we leave the metrics to the managers, we ask a very specific set of screening questions to gauge the level of ESG integration they use in their investment process. But delivering the best solution still takes an extra layer of diligence.”

For private investments the process is more complicated. “From the outset, we set appropriate metrics but metrics cannot be set in a vacuum,” adds Perrina. “When we define them in partnership with the project leaders or fund managers and our clients, it sets a level playing field. There are plenty of tools to measure the pure quantitative impact of an investment, but impact investing is about quality, value and utility and this takes a much deeper level of analysis.”

Finding the right opportunities

Based on these varying expectations of ESG outcomes, finding the right investment opportunities can be challenging for family offices.

“We need to turn over a lot of rocks to find investments that meet our clients’ demands, particularly for investments that have true impact such as those in renewable energy or affordable housing where the level of due diligence we do is significantly higher, as these are most often private investments,” says Perrina.

“With publicly available funds, it is necessary to distinguish those that are really doing the work from those that are simply using ESG as a marketing tool”.

Shah acknowledges that top-class products remain scarce in the part of the market the London-based wealth management company is interested in. “It is interesting to note that the majority of funds available are global and regional,” she adds. “Single country funds are practically non-existent, which could prove quite a challenge for some asset allocators.”

While other wealth managers might be restricted to funds by the size of the assets they are managing, family offices can turn to the direct investment market.

Half of the family offices UBS surveyed in its Global Family Office Report 2018 plan to invest more in direct private equity deals. Another survey commissioned for the FT’s Investing For Global Impact 2018 report found 69% turn to private equity for impact investing.

Laird Norton Wealth Management makes both funds and direct investments. Perrina explains that in addition to the analysis required to source and evaluate impact investing opportunities, the firm spends considerable time defining what its clients are trying to achieve and what utility they are deriving from the investment.

“For private opportunities, in addition to cutting through the marketing hype, you have to dig deep into the true operational and business issues to ensure it is a viable investment and really understand what the returns look like”.

Golden Equator Wealth also follows both strategies, with a slight inclination towards direct investments. “We value having control over any investments we take on, but adopting some funds aids in diversification, helps serve as a check to reassess our plays and keep us on our toes,” explains Lin.

“The complexity of the space and lack of common reporting framework mean we follow a fund-orientated strategy in listed equities, private capital and green bonds,” says Shah. “When we invest in funds, we look for managers who prioritise engaging with management teams to put sustainability at the top of the agenda.

“A sophisticated, robust and transparent stewardship policy is a must. Finally, we look for managers who assess a company’s sustainability not only based on the product or service provided but across the whole supply chain.”

Solutions incorporate a number of choices, including actively managed funds, passive strategies, quant strategies, public market thematic funds, private equity and venture capital impact funds as well as direct impact investments, adds Zimmerman.

Isdale says her clients have been able to find ESG opportunities when they are interested but are often not investing in these opportunities for reasons including fees, expected returns, soundness of the investment philosophy proposed by the ESG managers, and track record.

“If the family is going to be hands-on, I am usually focusing on whether they have the capacity to make these investment decisions and the process by which they – or their investment team in the family office – will source, review and select investments generally,” she concludes.