Given the blockchain’s potential to both disrupt and enhance processes and systems, there is undoubtedly growing interest among wealth management firms in using the blockchain to improve customer experience and remove inefficiencies. Industry experts talk to Robin Arnfield about where the blockchain’s attraction and potential use-cases lie

Central market infrastructure providers have demonstrated that the blockchain models and technology work. Now wealth managers are getting more interested in engaging with the blockchain.

Wealth managers and private banks are increasingly keen on identifying the best use-cases for blockchain, according to industry experts.

Javier Paz, senior analyst at Aite Group, says: “Several of Aite Group’s wealth management clients are interested in learning more about the blockchain, without disclosing names. They are looking at the blockchain purely for efficiency reasons rather than for strategic opportunities. For them, the blockchain is for practical implementations to reduce their overheads, and end users would never know they are using blockchain behind the scenes.”

Some interesting initiatives have already emerged, one being Northern Trust’s development with IBM of blockchain, or distributed ledger technology, for the private equity market. The technology is initially being used to manage the administration of a private equity fund run by Swiss asset-management business Unigestion.

Paz, who has authored several in-depth reports about various aspects of blockchain in wealth management, wrote in a blog: “Northern Trust carries out administrative functions for multiple private equity funds. These have unique life-cycles, complicated structures, and documents and ‘artifacts’ exchanged by parties using unique rules and permissions. The manual nature of this administrative work imposes time delays and a variety of costs to all parties…

“While custom-built to serve Unigestion’s needs, Northern Trust’s blockchain implementation will serve additional private equity clients over time. Northern Trust will control who is permissioned and for what access. The use of broadcast channels will distribute ledger information to the nodes that are permissioned to receive it.

“This planned solution will replace manual processes, not a system, but will modify how the private equity life cycle occurs for the various participants, while adding yet-to-be-disclosed extensibility benefits.”

Steve Webb, PwC’s Partner for Banking and Capital Markets Consulting, says several blockchain initiatives have been announced around fund management distribution platforms. “For example, BNP Paribas Securities Services has teamed with Axa Investment Managers to develop a blockchain-based fund distribution platform to improve information flow between fund buyers and sellers.”

The global funds transaction network Calastone announced, in mid-June, the successful completion of the first phase of its distributed market infrastructure proof-of-concept to test the feasibility of using blockchain to develop a common global marketplace for the trading and settlement of mutual funds.

In April 2017, Broadridge Financial Solutions, JP Morgan, Northern Trust and Banco Santander completed a blockchain pilot to enhance global proxy vote transparency and analytics. “The blockchain helps solve the difficulty of people participating in proxy voting,” says Paz.

In the US, John Hancock Financial’s Laboratory of Forward Thinking is testing the blockchain for on-boarding new wealth management clients with ConsenSys and Blockapps.

A growing number of private banks are analysing opportunities the blockchain could bring to their business, including bitcoin integration, shared know your customer (KYC) duties, and pension funds.

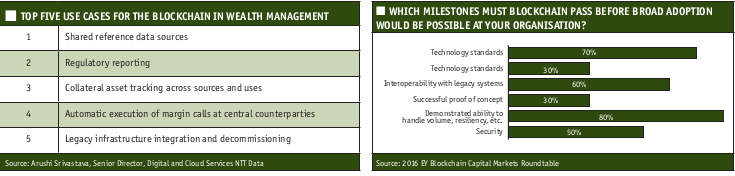

Arushi Srivastava, senior director, Digital and Cloud Services at NTT Data says: “We have US wealth management clients who are trying out initial use cases for blockchain in asset management.”

Annabel Spring, group executive, wealth management at the Commonwealth Bank of Australia (CBA), told the 2017 APAC Blockchain Conference in Sydney that the blockchain’s potential is “enormous” and CBA is “experimenting with it every day”.

“We’re looking at where the manual processes are, where multiple hand-offs are, and where the siloed data that requires reconciliations, exists. We are testing the benefits of making immutable transactions transparent; of digitally connecting and automating transactions between counterparties; of creating a single source of truth to alleviate the pain of inter-organisation processes and counter-party risk.

“We’re exploring how this could play out in terms of removing inefficiencies and risk for all participants in the global wealth management marketplace.”

KYC and identity management

According to Brian Lincoln, IBM’s Wealth Management Solutions Lead, there is huge interest in being able to improve the whole process around KYC and identity verification, “as these can be painful for HNWIs and

UHNWIs”.

Keith Bear, VP, Global Financial Markets at IBM, agrees, saying: “We have been seeing activity in KYC blockchain implementations in the sell-side, and there’s potential for wealth managers and private bankers to implement the blockchain for KYC and identity management.”

Will Trout, Celent’s head of wealth management research, says there is a lot happening in terms of blockchain-based identity verification. The UK’s Everledger, for example, is using blockchain to register diamonds.

“This process can be quickly extended to human beings with biometrics registered on the blockchain, but it needs to be accepted by the various bank blockchain consortia, such as R3, as an acceptable verification method,” he notes.

Client-onboarding – a notoriously cumbersome area for private banks – could benefit from the blockchain. Philippe Meyer, managing director of private banking software firm Avaloq’s Edinburgh-based R&D centre, says: “On-boarding clients is increasingly expensive and most customers have multiple banks to reduce their counterparty risk. Sharing the on-boarding KYC data between banks could help limit costs. The biggest advantage the blockchain brings is eliminating the need for reconciliation. As everyone shares the same information, there is no need any more to reconcile the different transaction databases.”

Blockchain provides immutability, which is interesting for proof-of-ownership or for KYC data, says Meyer.

However, the challenge is to bring all the participants onto the same architecture. “The blockchain makes full sense when shared among a number of participants, aligning them onto the same infrastructure will be challenging,” he adds.

Lincoln says that, for regulatory reasons, using the blockchain for KYC/identity verification internally within a bank is much easier than across multiple banks. “For example, when an existing retail banking client has an opportunity to upgrade to private banking, the blockchain could be used to leverage information that has already been captured and streamline the on-boarding process.”

Longer term, Trout sees huge opportunities for end clients for blockchain-based self-service analytics and reporting data ‘on the fly’. “Since they would not rely on intermediaries to provide these functions, they would access the data directly. Likewise, blockchain-based smart contracts could serve as a starting point for new types of products, such as ETF-like baskets of stocks built off smart contracts. But this is at least a decade away,” he adds.

Attraction of the blockchain

The central market infrastructure providers, for instance the exchanges, the Central Securities Depositories, and the Depository Trust & Clearing Corp., have taken the first moves with the blockchain in financial services. A key reason for this is that the blockchain is a way to do things at lower cost, for example in credit default swaps, or to facilitate new business models.

Steve Krieger, Pictet Group’s project director, says blockchain’s promise of faster, cost-efficient transactions with a reduced risk of errors attracts private banks’ attention.

“For us, fund distribution and OTC securities transactions provide attractive use-cases. While still at an explanatory stage, we’re participating in consortia to develop joint prototypes for fund distribution, and have started to experiment on small internal prototypes in the OTC space to get first-hand experience.

“Agreeing on common standards for different institutions involved in the ecosystem takes time, and there is little clarity on many business cases related to the blockchain. We expect that clear business cases will emerge in the near future on specific use-cases, which will accelerate developments,” he says.

Chris Owen, vice president, blockchain at Canada’s TD Bank Group, says part of blockchain’s appeal is its ability to settle transactions in seconds or minutes automatically via computers. “It is a potentially more secure settlement process than what is used today among financial institutions, where clearing houses and other third-parties validate accounts and identities over a few days.”

However, there are still tough challenges to work through, including technological, business and political aspects, says Owen.

“As it pertains specifically to TD’s Wealth business, we’re currently conducting a review of those processes that would be most positively impacted using blockchain technology. The blockchain is a technology that we are looking at very closely.”

Assets agenda

With the blockchain creating the ‘Internet of Value’, Meyer says the increasing development of digital assets across most industries can be expected. “We see proof-of-ownership blockchain systems being created for assets such as diamonds, real-estate, and cars,” he says.

“As the blockchain evolved from bitcoin, regulators have been hesitant to support the blockchain. But they have now understood that the blockchain brings the transparency they require, in particular for OTC transactions. We expect that regulators will become core stakeholders in the development of distributed ledger technologies going forward.”

As has already been demonstrated by Northern Trust and IBM’s initiative, to name one, private equity also “lends itself very well to the blockchain”, says Lincoln.

“There is a lot of complexity in private equity with a lot of entities involved, and it’s an inefficient process with a poor user experience. From a risk/audit perspective, there tends to be regulatory concerns about whether the institution is selling to accredited investors.

“It also needs to demonstrate it has robust processes that ensure all the necessary documents were on file in advance of the client subscribing to the private equity and that it provided the appropriate disclosures. These concerns are addressed by the blockchain,” says Lincoln.

There is no doubt that now is the time to think about the blockchain’s place in wealth management. “Firms also realise that, if they are looking to invest in their core systems now, they should be factoring in the blockchain,” adds Lincoln.

Private banks and wealth managers are certainly not ignoring this technology, though many have been taking the ‘wait and watch’ approach so far.” However, as CBA’s Spring said at the conference in Sydney: “It is in wealth management where we can really make transformational change by simplifying the complexity.”