Billionaries: Wealth Management Cater Strategies for the Super Wealthy

Billionaires are not just unique because of their wealth. Most live cross-border lives, requiring a different kind of wealth management service. David Craik meets the firms catering to these new needs.

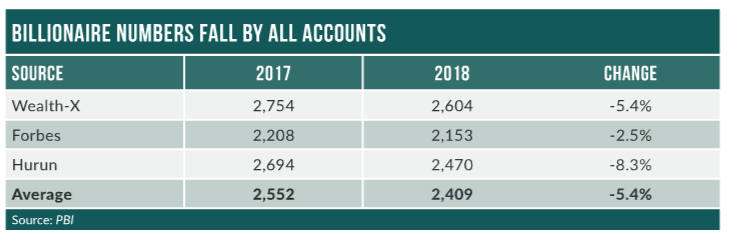

A handful of studies have shown that wealth at the very top has fallen. This year’s Capgemini ‘World Wealth Report’ said the number of millionaires fell for the first time in seven years. UHNWIs – those worth over $30 million – accounted for 75% of the decline of wealth in 2018. Their number dropped by 6%.

“The steady rise in global wealth growth came to a sharp halt in 2018”, was the opening line of the BCG ‘Global Wealth Report 2019’.

Finally, Forbes counted 247 fewer billionaires this year compared to the year before, as the fortunes of the richest plummeted.

Market volatility, global trade tensions and economic slowdown were to blame for the slowdown according to Wealth-X which reckons billionaire wealth declined 7% to $8.6 trillion in 2018 with the number of billionaires dropping 5.4% to 2,604.

This punishing blow to their net worth has led to changes in a typical billionaire’s portfolio over the last 12 months, says Maya Imberg, director, Thought Leadership and Data Analytics at Wealth-X. “We are particularly seeing the growth in the demand for wealth management amongst emerging markets billionaires. This is in areas such as investing, wills, tax structures and preservation”.

Amidst this bad news, several firms are either upping their focus on UHNWIs, or setting up to serve this exclusive market.

One of these is the new Monaco and Mayfair based wealth management firm, Azura, which accepts clients with fortunes of around $250million.

Going live before the end of July, Azura, led by former Julius Baer banker Ali Jamal, promises to provide ultra-wealthy entrepreneurial investors with the ‘human connection’ he believes is presently not being met by private banks.

“Azura has been born out of our clients’ wishes for more connected and personal relationships,” explains Jamal. “They are global citizens with diverse and complex sources of wealth and find current wealth management services to be too segmented and disrupted by differing national regulations.

“For example, they need to open a different bank account in Asia if they have wealth there or the States or Europe. But no one bank can serve the needs of a billionaire. We want to make it easier for them, build long-term relationships and provide a better human connection.”

Azura, based on an open architecture platform, will have around $2billion of advisory assets under management at its launch and is aiming for $5billion by 2022. It will offer global multi- family office and independent asset management as well as engage in ‘club deals’ (see page 10/11) either in assets or companies.

“We aim to serve clients in every jurisdiction and work closely with a global network of banks to find the best solutions for our clients,” Jamal adds. “We aim to be a one-stop shop for clients looking to buy equity in a business, a property in London, a plane or a summer house in Sardinia. We will help with their wealth management and ensure they find the right investment manager, performance, efficiency and execution prices for their needs. We want to disrupt the established global private banking and UNHWI advisory market by offering our clients more.”

Boutiques vs. established

Incumbent wealth managers believe they are already offering a personalised service to the world’s wealthiest, however. Though these firms also need to adapt to today’s ultra-high-net-worth.

J.P. Morgan boasts that it caters to 40% of the world’s billionaires. Its private banking operations in the UK and Ireland and Switzerland cater only to UHNWIs, who are typically “entrepreneurs, business owners and families”, says Oliver Gregson, head of Private Bank UK & Ireland.

Tier 1 banks like J.P. will continue to have the upper hand over boutiques, Gregson believes, simply because they can absorb the increasing costs of regulation, technology and running large research teams.

“The cost of operating has continued to increase in a world when revenues have been pressured. We’ve seen a reversal of that trend as these smaller organisations have recognized that hiring a lot of people after the financial crises and bringing on board all of those fixed costs is not an optimal model and they’re starting to unwind that.”

One of the challenges is the rapid response required in managing the wealth of ultra HNWIs and billionaires, says Pierre Masclet, deputy CEO in charge of business development at Indosuez Wealth Management Group. “Our organisation is set up to quickly roll-out our expertise by operating teams around the world. Senior management and experts are readily available, and the decision-making process can be fast.”

“Billionaire wealth is highly diversified in terms of asset classes. Beside the ‘traditional’ management of financial assets and wealth structuring, our services for billionaires also encompass solutions to manage alternative assets, such as real estate (financing residential or commercial property), access to ‘club deals’, private equity with access to the best LPs of the market or direct co-investments. Philanthropy and access to non-listed assets are must-haves.”

A new breed of advisor

Joe Stadler, head of Ultra High Net Worth at UBS, stresses the importance of hiring individual advisors who can “discuss whatever is on a client’s mind.

“We speak to the most interesting people on the planet – entrepreneurs, investors, self-made people – and you have to have a broad-based understanding of many things to be relevant to these sophisticated clients. For example, I am fascinated by geopolitics and history, and many of our clients are interested in or concerned by what is going on in the world and how it impacts their investments.”

Hiring UHNWI advisors has become highly competitive among the big named banks. BMO Family Office, BMO’s recently rebranded UHNW division, just hired Shannon Kennedy from BNY Mellon as its new head. Credit Suisse UK has hired five from UBS, with a focus on UHNWIs. In Switzerland, UHNWI heads have recently exchanged hands between J.P. Morgan, UBS, Goldman Sachs and Lombard Odier.

Ethical Billionaires

It is not just the impacts on their investments that are on an UHNWI’s mind, but the impact of their investments as well.

“One of the biggest trends is definitely the integration of ESG investments/criteria in all assets, listed or un-listed, such as private equity or real estate”, says Masclet. “Every request for proposal from our UHNWI clients must incorporate ESG. It’s a must-have”.

Wealth-X added that this is mirrored by a higher expectation from society for billionaires to give back.

“There is a difference in outlook amongst the new generation in that they want to use their wealth to make an impact,” says Imberg. “ESG is not just an interesting investment strategy – they want to get directly involved with enterprises making a difference. They want to be more hands-on.”

Jamal of Azura adds: “Yes, they are interested in advice and services around inheritance and investments, but they also want to add value to society. How can we help them utilise their wealth to help charities, philanthropy or environmental concerns? They want to create stability for the next generation. It is very important to them.”

Banking on a billionaire boom

Despite all major metrics showing a decline in the number of UHNWIs in the past 12 months (see table), a number of wealth managers clearly believe there is a business case in banking billionaires.

“Client activity remains high there, with the number of transactions up even though their size is currently under pressure due to market uncertainty,” says Stadler.

“Client activity remains high there, with the number of transactions up even though their size is currently under pressure due to market uncertainty,” says Stadler.

“We need to bring in advisors with particular specializations and new perspectives – also from investment bank and asset management – to work with clients and offer them products tailored specifically to their individual requirements.

“Big money tends to grow faster”.

Additional reporting from Oliver Williams