Coming into the year, there was a good deal of pessimism, especially around equities, but a feeling that the worst may have been behind us for the fixed interest markets. Cash was expected to continue to perform well compared to the other asset classes, and property was expected to struggle against multiple headwinds.

The reality for the current calendar year (fig.1) has been that equities have probably exceeded expectations, cash has performed in line with them, and property and fixed interest took until nearly the end of October before recovering earlier losses and approaching the 0% return line.

Equity, Fixed Interest, Property & Cash Performance – 30/12/2022 to 17/11/2023 (fig 1)

A New Era?

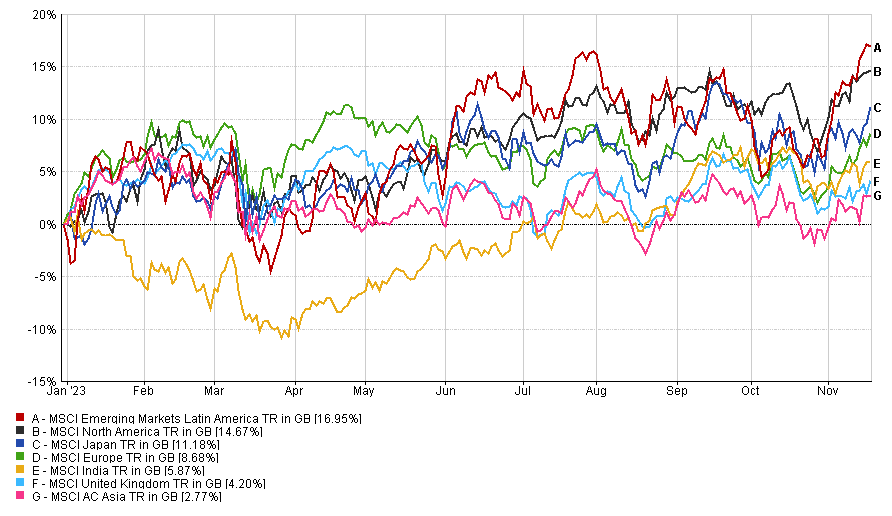

If we look under the bonnet of the different equity markets, we see wide performance divergence between the regions and countries (fig.2).

The stand-out success story is once again Latin America, especially Brazil and Mexico. These countries are large commodity exporters and continue to benefit from global geopolitical tensions. It is widely considered that globalisation peaked somewhere around the start of the pandemic, and until then, countries and businesses were running ‘just in time’ supply chains.

The pandemic brought home to companies just how fragile this working method was. Reshoring, also sometimes called friendshoring, is now a strategy many companies have adopted, meaning they are looking to partner with companies in countries they consider more reliable. For the US market, as an example, this would mean a preference for countries such as Mexico over China.

Selective Country & Regional Performance – 30/12/2022 to 17/11/2023 (fig 2)

Different Winners and Losers

As we retreat from peak globalisation and enter a new era, there will be many more examples of governments and companies engaging with new partners to strengthen their supply chains. This will produce different winners and losers, but Latin America seems particularly well-placed to benefit, given the nature of the underlying economies.

At the other end of the scale is China, which, despite being the world’s second-largest economy is likely to continue losing out in some markets. Given the actions of the communist government in the last few years, it is considered unreliable and is often referred to by some American politicians as uninvestable. We would caution against writing China off, however, and the communist leadership know full well they have to manage a thriving economy if they are going to retain the support of the Chinese people.

What next for Fixed Interest?

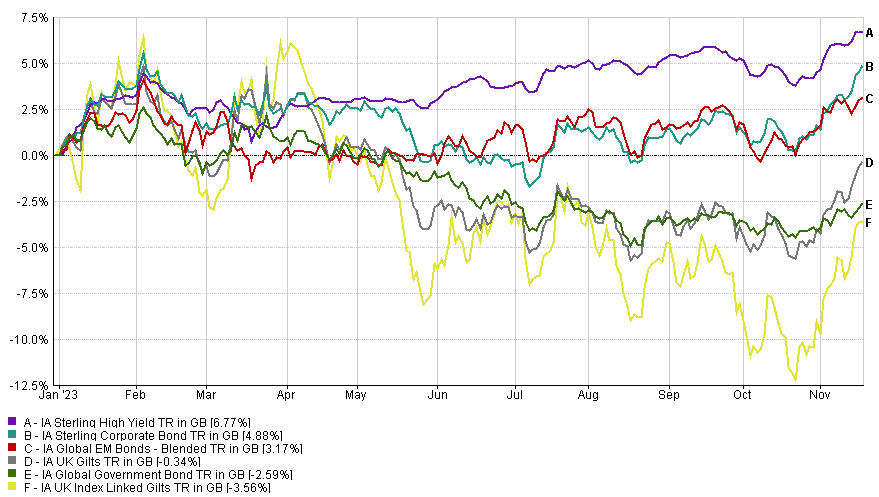

As with equities, if we delve a little more deeply into the fixed interest (bond) markets (fig.3), we see the underlying sectors have performed very differently.

The UK’s index-linked market had been under relentless pressure since the central banks of the US, the Euro area and the Bank of England woke up to the realisation that inflation was not a temporary issue. The situation became more acute after the disastrous mini budget during the brief tenure of Liz Truss, but in recent weeks, the situation has started to turn around.

The UK high yield and emerging market debt markets, which are the riskiest sectors, have held up relatively well, as has the wider UK corporate bond sector, though admittedly from a low base.

Fixed Interest Sector Performance – 30/12/2022 to 17/11/2023 (fig 3)

2023 brought much market volatility, which can be uncomfortable for many investors. These conditions may also have tempted some clients to move their risk asset investments to high interest cash accounts that have not been seen for many years, offering a guarantee of circa 5% at points throughout the year.

However, volatile conditions often present the best opportunities for investors. The entry price in Fixed Interest and Equities and the level of Sterling versus other currencies dictates most of the returns for UK investors. As we stand here today, we are optimistic about the outlook for both bonds and equities due to these respective starting prices and the current Sterling stability.

To take advantage of this opportunity set, it is vital to remain diversified across assets, regions, and styles. The era where interest rates were near zero and inflation tightly contained is over, at least for now, and in summary this means new, but different, opportunities.

Chris Metcalfe is the chief investment officer at IBOSS, part of Kingswood Group.