US millionaires have the lowest adoption rate of sustainable investments, according to a study published by UBS in September 2018. This may be true for now, but the next generation of HNW individuals will change this.

With the number of impact investing funds on the rise, the UBS report looked at HNW investors with at least 1% of liquid assets allocated to investments linked to environmental, social, and governance factors. Out of the countries surveyed, the US had the least appetite for sustainable investing, with only 12% of HNW individuals having them in their portfolios.

The results of the study remain in line with findings from the 2018 Global Wealth Managers Survey. Although 90% of US providers we interviewed have socially responsible investments in their HNW proposition, the demand they experience for such products is moderate at best. On a 0% (very weak) to 100% (very strong) scale, sustainable investments stand at 50.1%. This is the lowest level of any service in the US wealth management market – and it is forecast to increase only slightly over the next year.

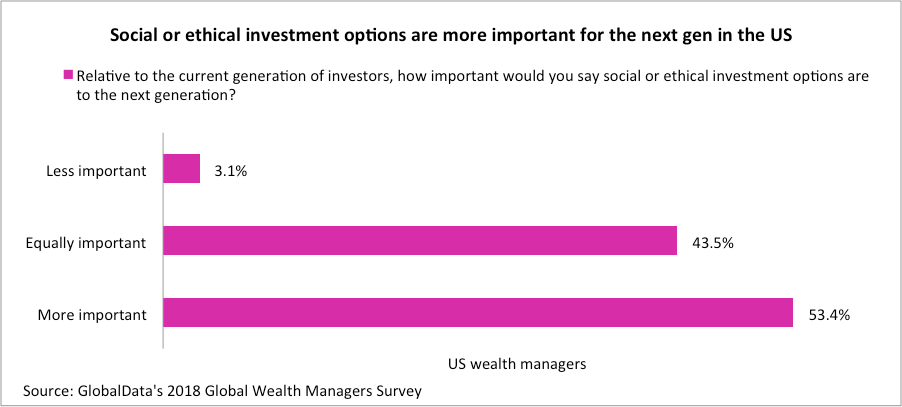

Although sustainable investing may not currently be the biggest asset class, that does not mean providers should omit it in their proposition. Parallels can be drawn with robo-advice: both offerings are ahead of their time, but will be key for the next generation. Indeed, the majority of US wealth managers surveyed by GlobalData believe socially responsible investments are more important to the next generation than the current generation of clients. Research shows that millennials are committed to their money having more of a social impact than their elders, and wealth managers’ views echo this.

As generational wealth transfer approaches, wealth managers will need to ensure the next generation’s needs are met sooner rather than later. And heirs are likely to start influencing their parents’ investment decision even before the actual wealth transfer. Wealth managers need to adopt or expand their sustainable investments, as demand for these products will only grow.