Investors in Hong Kong are keen robo-advice users and picking up new business is not the challenge – keeping it is, according to GlobalData Financial Services

On average those using robo-advisors in Hong Kong earn a higher income and hold more financial products, making them an attractive target market. However, GlobalData’s 2017 Retail Banking Insight Survey further shows that they also tend to be more prone to switching – a trait typical of younger customers.

Investors in Hong Kong are keen robo-advice users, and picking up new business is not the challenge, keeping it is. Admittedly, in a non-saturated market where new business is plentiful this does not represent a problem per se – at least not for now. But the segment will not always be on its high growth trajectory.

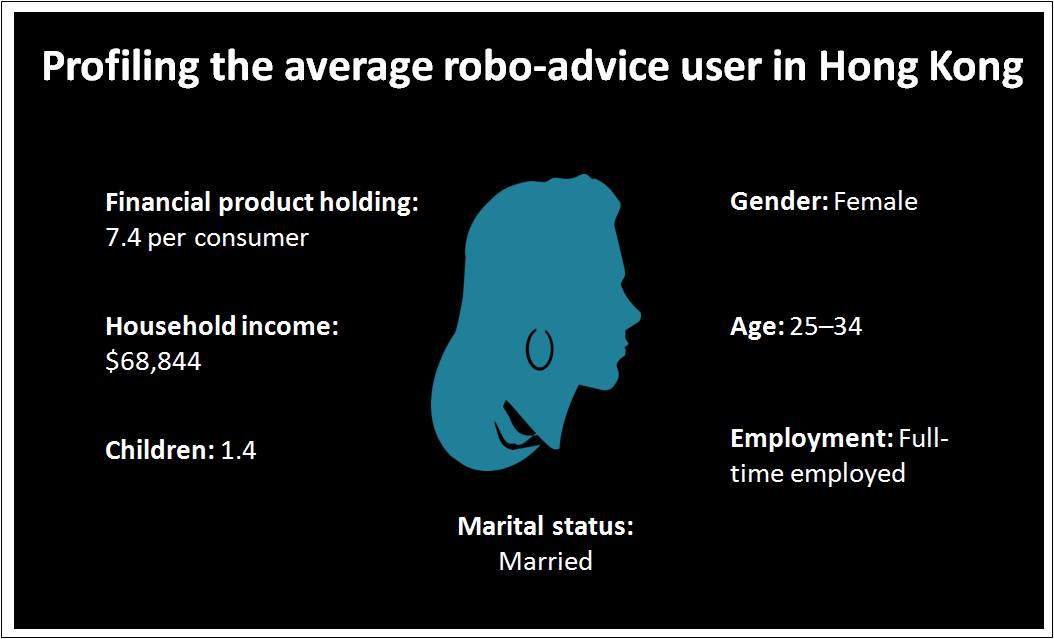

An analysis of the demographic and attitudinal profile of the average robo-advice user in Hong Kong suggests that digital providers have to up their game. It will be those able to build up loyalty among a notoriously disloyal customer segment that will be successful in the long term. An increased focus on the convenience aspect as well as customer loyalty should become more important.

Of course, there is no one single solution, but a transparent fee structure, great customer service, targeted communication, and a hint of the human touch should problems arise can work wonders. Retention is always higher when banks exceed customer expectations, and this is certainly the case in the wealth management industry.

At the same time, the convenience robo-advice provides cannot be underestimated, and should feature strongly as part of every provider’s targeting campaign. Aged between 25 and 34 years, with one or two children, the typical robo-advice user is busy juggling responsibilities while building a career. In fact, time pressure is of significantly more concern among those using robo-advice than those preferring traditional channels, making it an angle that can be exploited in marketing.

According to GlobalData Financial Services, providers that take a long-term view – getting to know the life goals and behaviours of their clients with the aim of fulfilling them – will still be around once market saturation rises.