HNW investors employ multiple wealth managers to oversee their wealth. With over half of this kept with their primary wealth manager, ensuring lead position is critical for building AUM according to GlobalData Financial Services.

Of the bulk of HNW wealth that is managed professionally, this is often spread across multiple wealth managers.

In fact, only 15.2% of HNW investors work with one wealth manager.

HNW investors have complex portfolios and investment priorities, and can benefit from leveraging the expertise of more than one professional manager.

Furthermore, clients can take advantage of risk and strategy diversification among professionals, and there is the benefit many feel they get by not putting all their eggs in one basket.

With the exception of North America, it is most common for HNW investors to rely upon three professionals to manage their wealth.

As HNW investors are comfortable spreading their risk across multiple professionals, this creates competition among wealth managers in overseeing the greatest proportion of their clients’ portfolios.

Adding to the competition among wealth managers is the notable proportion of client wealth kept with the investor’s primary wealth manager.

Adding to the competition among wealth managers is the notable proportion of client wealth kept with the investor’s primary wealth manager.

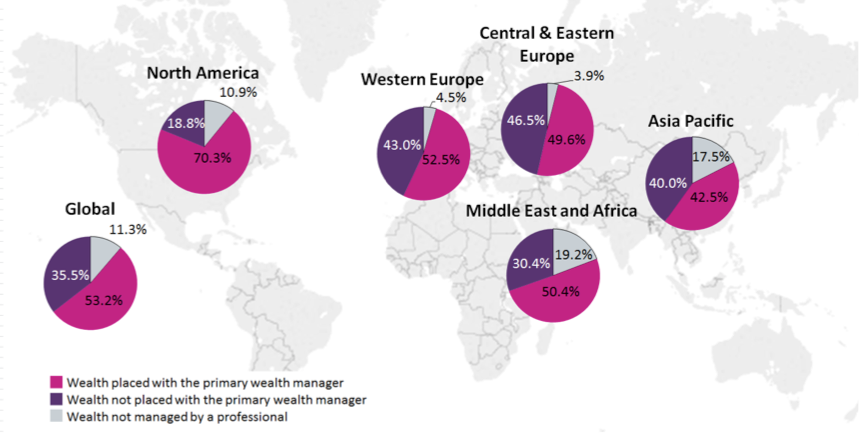

Our survey shows that on a global level, 53.2% of HNW wealth managed by a professional is kept with their primary manager, a hefty prize.

But on a regional level, wealth managers in North America manage much more than half of their clients’ total wealth.

This is in part due to a strong preference for discretionary mandates, in which the wealth manager makes day-to-day decisions on behalf of their client based on their investment preferences and goals.

Individuals in North America are also more likely to have inherited their wealth compared to individuals in other regions, and therefore rely more on the expertise of professionals.

Given the importance of winning the lead position, wealth managers need to remember why HNW investors are seeking professional advice in the first place.

GlobalData 2017 survey

GlobalData’s 2017 Wealth Managers Survey has highlighted convenience and expertise as the top reasons for obtaining professional advice among HNW investors the world over.

Wealth managers need to ensure they are excelling in delivering superior convenience – whether that is through digital channels or a hands-off discretionary mandate – and are seen by their clients as true experts in their field.

That means knowing clients’ expectations and preferences at a deeper level than simply their risk tolerance.

This is a time-consuming and highly personal task to be sure, but one that will reap rewards with much greater business volumes.

As HNW individuals continue to seek the advice and support of wealth managers, strategies for client acquisition are even more important.

With the potential to secure a greater proportion of client wealth in the hopes of becoming the primary manager for their clients, professionals will do well to understand the needs of their clients to ensure they are providing relevant products and services.