Cryptocurrencies, in particular bitcoin, have emerged as the investment phenomenon of the pandemic. However, they stand in stark contrast to sustainable investment values, which are increasingly ingrained in the global investor’s psyche, especially among younger investors. Cryptocurrency needs to learn from ESG.

COVID-19 has fast-tracked many trends, including some in the investment space. Retail trading exploded at the onset of the pandemic, as an avalanche of new investors entered the market looking to capitalize on volatility and cheap buying opportunities. These new entrants are typically younger, first-time investors, falling into the Gen Z or Millennial segments. At least to some extent, this has accelerated the acceptance of bitcoin, given the segment’s greater uptake of cryptocurrencies. As a result, the price of bitcoin has increased by roughly 650% since January 2020 as investors have flooded the market.

Another trend accelerated as a result of the pandemic relates to environmental, social, and governance (ESG) investments. Public concern and advocacy for ESG investment products among investors was already on the rise before the pandemic, but COVID-19 has further fanned the flames.

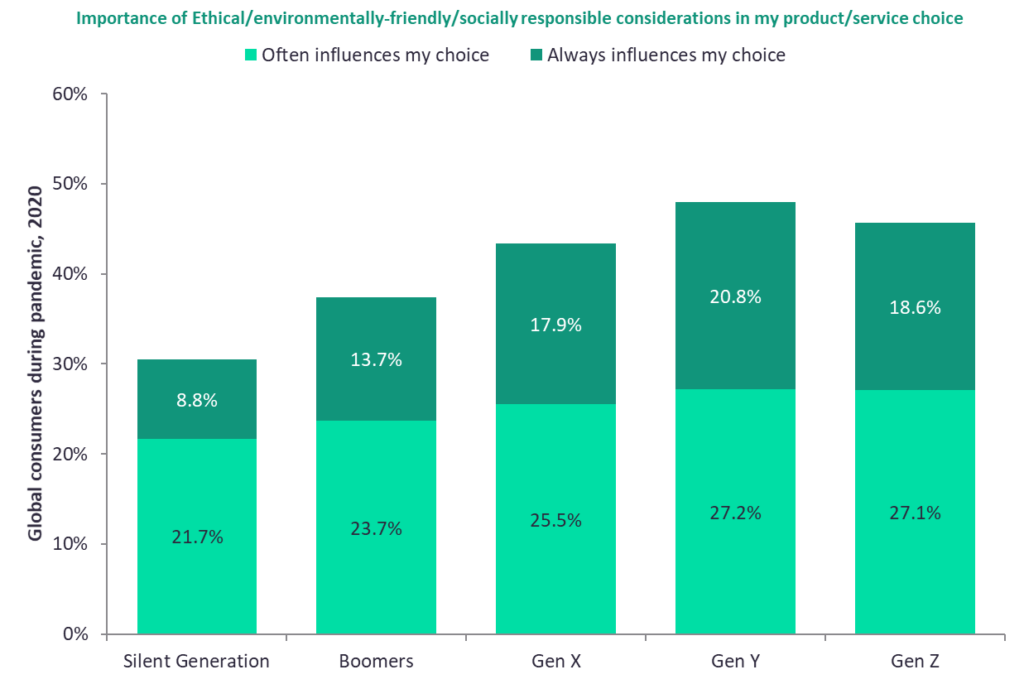

Once again, the desirable Gen Z and Millennials segments, in particular, have been driving forces behind sustainable investment uptake, and our data shows that younger generations regard social and ethical investment options as notably more important than the Baby Boomer segment.

Yet while both ESG investments and a fascination with bitcoin have been exacerbated by the pandemic, these trends are inherently incompatible. The University of Cambridge Bitcoin Electricity Consumption Index ranked bitcoin’s annual electricity consumption above that of Argentina (121 TWh) and the Netherlands (108.8 TWh). With one transaction using roughly 713 kilowatt-hours of electrical energy, the investment stands in stark contrast with Gen Z’s and Millennials’ sustainable investment values, raising the question of these trends’ sustainability. Are younger generations just paying a lip service to ESG matters?

Environmental and social issues are not just going to disappear overnight. This is not to say that the allure of bitcoin will, but ESG investments – while fast-tracked by COVID-19 – have been gaining momentum for years in line with growing awareness of these global issues. Awareness of the environmental effects of bitcoin, on the other hand, remains limited for now.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataHowever, it is our view that eventually, it will be a value-driven investment approach that will transform the cryptocurrency market. In the not-too-distant future, we are likely to see more efficient cryptocurrencies that are completely powered by clean energy, achieving net-zero emission.

Source: GlobalData’s 2020 COVID-19 Recovery Tracker March-December

Source: GlobalData’s 2020 COVID-19 Recovery Tracker March-December