China is a dream come true for robo-advisors: strong consumer demand, a rapidly rising middle class, and a shift towards investment products outside of deposits make the country an ideal playground for automated investment services.

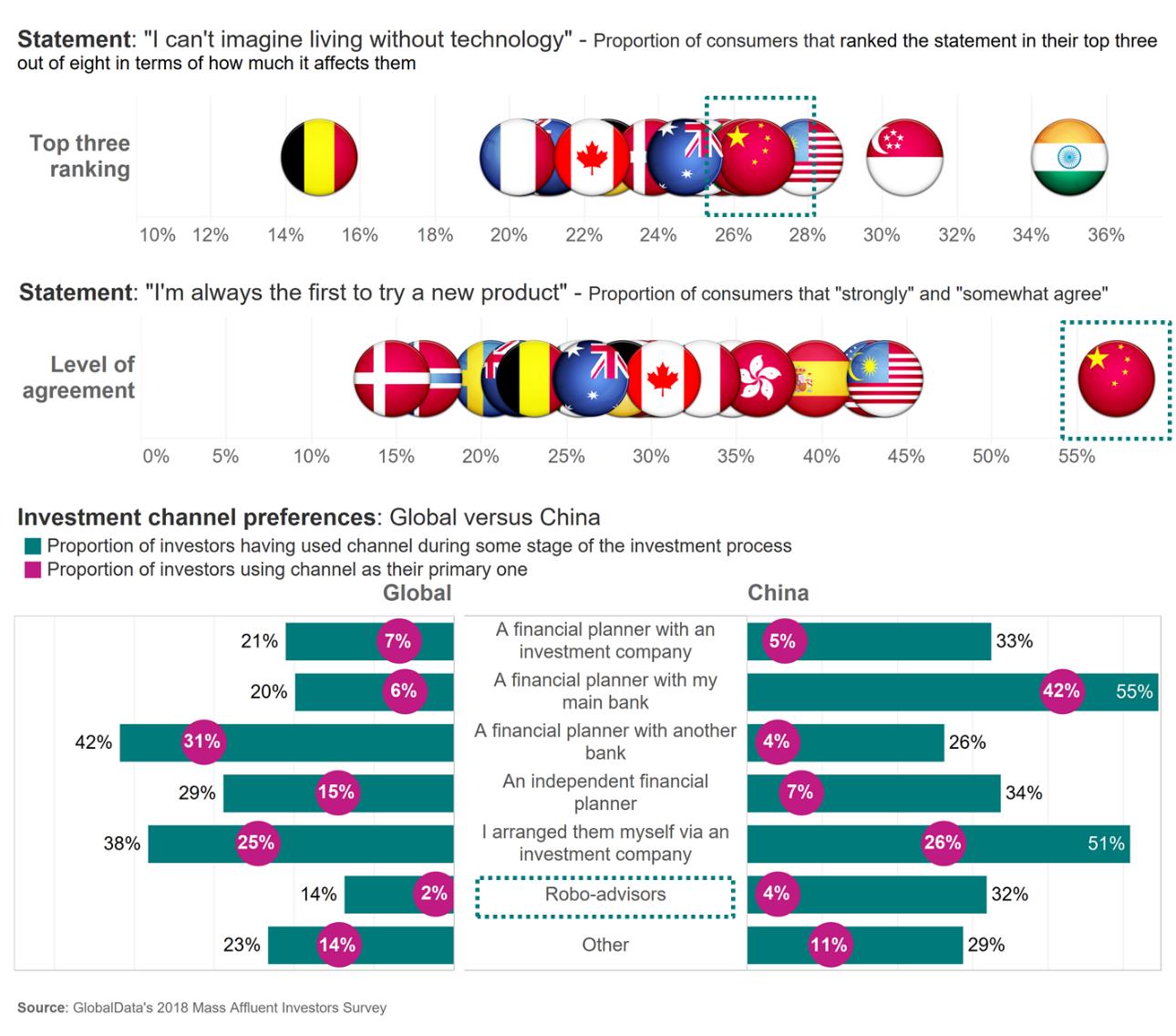

Technology is an integral part of everyday life in China, and local consumers lead the way when it comes to adopting new technologies. Participants in GlobalData’s 2018 Mass Affluent Investors Survey were asked to rank eight statements according to how much they affect them. More than a quarter ranked the statement “I can’t imagine living without technology” within their top three, meaning only a few countries in the world place greater importance on technology. Meanwhile 57.3% of Chinese investors state that they are “always the first to try a new product,” making them more open to new business models.

As such, it is unsurprising that Chinese investors are also more likely to make use of automated investment services than their global peers. While only 4.2% of Chinese consumers use a robo-advisor as their primary investment provider, this is almost double the global average of 2.3%. And the proportion of individuals who have at least tried a robo-advisor stands at 31.8% in China, compared to 13.7% on a global scale.

Admittedly, new entrants will face competiton from China’s big tech giants, such as Ant Financial and Ping An-backed Lufax, as well as start-ups like WaCai. And the country’s big banks – including China Merchants Bank – have developed their own robo propositions. Yet China’s investment market is set to grow rapidly, meaning it is far from saturated.

China’s wealth

China’s wealth

Going forward, growth will further be aided by a shift out of deposits and greater uptake of investment products. According to GlobalData’s Retail Investments Analytics, Chinese consumers allocate 72% of their liquid wealth to deposits, while another 20% is allocated towards equities. The remainder is split between mutual funds and bonds. For a developing market, the proportion allocated to fee-bearing investment products is already relatively high. However, there is room for growth – in India, for example, consumers only hold 56% of their liquid wealth via deposits. As the Chinese investment market continues to mature we expect the proportion of non-deposit holdings to continue to rise, further contributing to the development of the local robo-advice market.

A growing middle class is another trend in favor of automated investment platforms. Millionaires and HNW investors are often the key focus in China’s wealth market, with competion in this space increasingly fierce. But this is changing. Over the next four years, another 8.3 million individuals will qualify as mass affluent as per GlobalData’s Wealth Market Analytics. This equates to another $1.7tn up for grabs, which constitutes a signficant opportunity for robo-advisors. Investment management companies should shift their focus to investors lower down the wealth spectrum, as the automation of investment processes is turning the masses into a profitable target market.

China’s regulatory environment can be uncertain, and more stringent government scrutiny and involvement is likely as robo-advice continues to develop. But this should not be enough to act as a deterrent. China’s robo-advice market is taking off, and the opportunity is too good to ignore.