Similar to other countries, Swiss HNWIs hold the majority of their investments in liquid assets. However, these traditional assets have not been yielding the strong returns seen in past years. The negative interest rate imposed by the Swiss government and the Swiss National Bank (SNB) in 2015 has had a direct effect on deposit and bond holdings, making them less appealing for investors. Looking ahead, GlobalData believes stock market troubles brought on by global and regional factors will dent capital appreciation opportunities for both equities and mutual funds once again. With these assets not looking promising for driving growth, the Swiss are keen to explore other ways to expand their wealth.

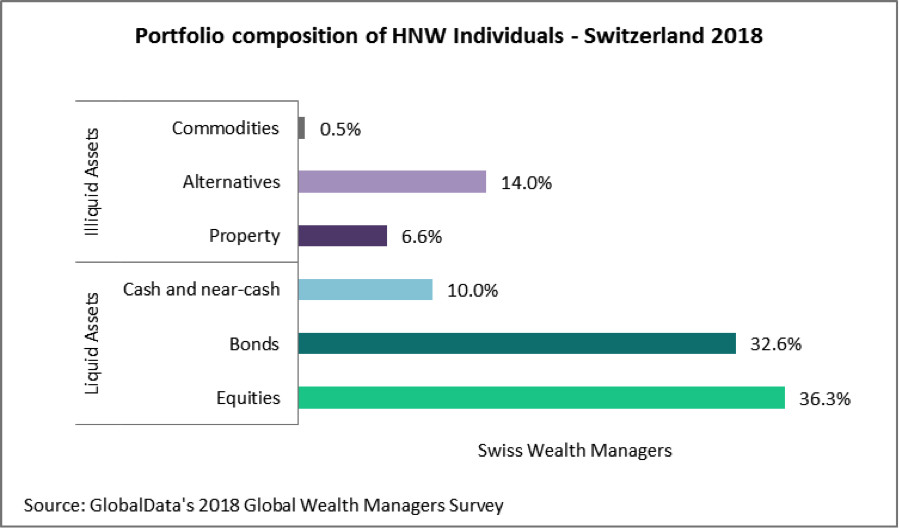

Investments in illiquid assets will therefore grow in prominence. Already they comprise 21% of the HNW portfolio in Switzerland according to the 2018 GlobalData Global Wealth Managers Survey, which is in line with global averages. Of those illiquid assets, 66% are held in alternatives, particularly hedge funds. Commodities, although only compromising 0.5% of the Swiss HNW portfolio, are forecast to increase according to the majority of wealth managers surveyed in 2018. However, property investment will continue losing its appeal due to stagnating property prices in a depressed local market, inclining investors to view commodities and alternatives as worth the risk.

Global risk and negative interest rates are causing Swiss residents to shy away from investing in traditional asset classes, and this trend will continue over the next two years. Wealth managers will need to bring non-traditional illiquid investment ideas to the table and provide detailed expertise to ensure their clients obtain the returns they require. It is time to refresh the alternatives and commodities investment line-up.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData