The coronavirus-induced market turmoil will not only have a significant effect on investor behaviour but also customer churn. Now is the time to test advisers’ communication skills and assure clients that they are on top of things.

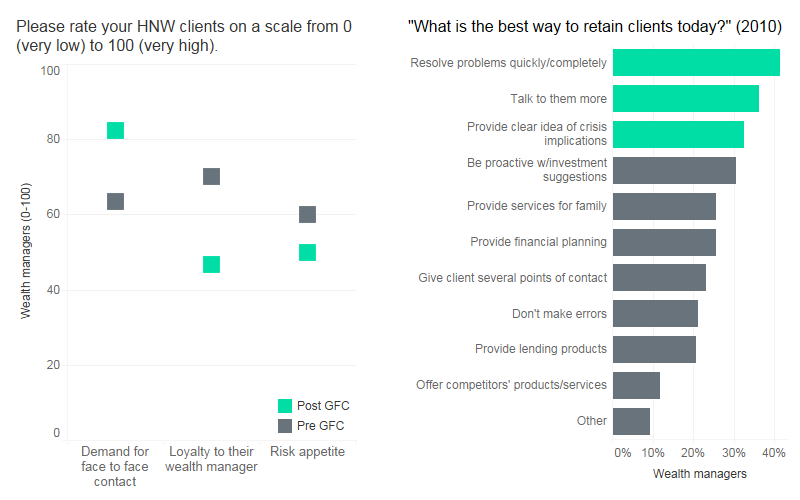

The 2007–08 global financial crisis (GFC)is more than a decade ago, but it provides industry participants with valuable insights on what to expect from the current crisis. For example, data from our pre- and post-GFC surveying shows a significant change in HNW customers’ attitudes towards risk. We asked wealth managers to rank their clients’ risk appetite on a scale from zero to 100 before and after the crisis. Within less than a year, risk appetite fell by 10 percentage points from 60 to 50.

A sell-off or a move away from risk products would not only have a devastating effect on the long-term performance of investors’ portfolio –it would also have a direct and negative effect on wealth managers’ fee income. With investors’ risk appetite dampened, wealth managers would need to encourage clients to take a long-term approach or even capitalise on cheap buying opportunities.

In 2010 we talked about the effectiveness of various means to encourage HNW clients back into riskier products after many suffered significant portfolio losses. Interestingly, factual and bullish reports and forecasts proved to have little effect. Regular encouragement from relationship managers, on the other hand, was the single most important driver of riskier products.

In fact, proactive advisory engagement will be critical during all stages of the current crisis. Our surveying during and after the GFC clearly highlighted the negative effect it had on retention rates, as clients(at least in part)blamed their advisers for lost portfolio value. On a scale from one to 100, we asked relationship managers to rate their HNW clients’ loyalty to their wealth manager. The loyalty ranking fell from 70 before the crisis to 46.7 in 2009, decreasing by 23.3 percentage points.

The situation is unlikely to be different today. Our latest results show that six in 10 wealth managers believe that volatile market conditions have a negative effect on client retention rates. Yet a larger proportion of wealth managers regard a financial market downturn as an opportunity as opposed to a threat, showing either overconfidence or an overinflated sense of security. Ultimately, someone’s gain in assets under management represents an outflow to someone else.

According to our data, almost a fifth of HNW investors seek out professional advice as they expect better returns through advisers. At the same time, performance and return on investment are key to client retention, suggesting that increased churn rates are inevitable. The S&P 500 has dived by more than 20% since the beginning of March, and understandably clients are anxious.

To avoid a repeat of the customer churn experienced in 2008, client engagement will be paramount. After the GFCwe asked relationship managers about the best ways to retain clients.Communication –i.e. providing them with a clear idea of the implications of the crisis – and the ability to resolve problems rapidly emerged as the single most important factors. In line with this, wealth managers also reported a sharp increase in demand for face-to-face contact. Between 2008 and 2010 demand rose by 30%, putting significant strain on advisers.

Current data reflects the same sentiment. A longstanding adviser relationship is the only means of customer retention that trumps return on investment. First and foremost, this means the onus is on advisers to assure clients that they are monitoring the situation.

Reliance on advisers in bull markets is low. Now we have entered bear territory is the time when clients will most appreciate what their adviser does. Ultimately, wealth managers that can effectively communicate, set expectations, and take the time to explain different scenarios will be able to turn the current downturn into an opportunity and prove their worth.