As their financial strength continues to expand, the opportunity presented by NRIs will become increasingly lucrative for wealth managers. However, domestic companies will need to refine their targeting strategies in order to compete with international players.

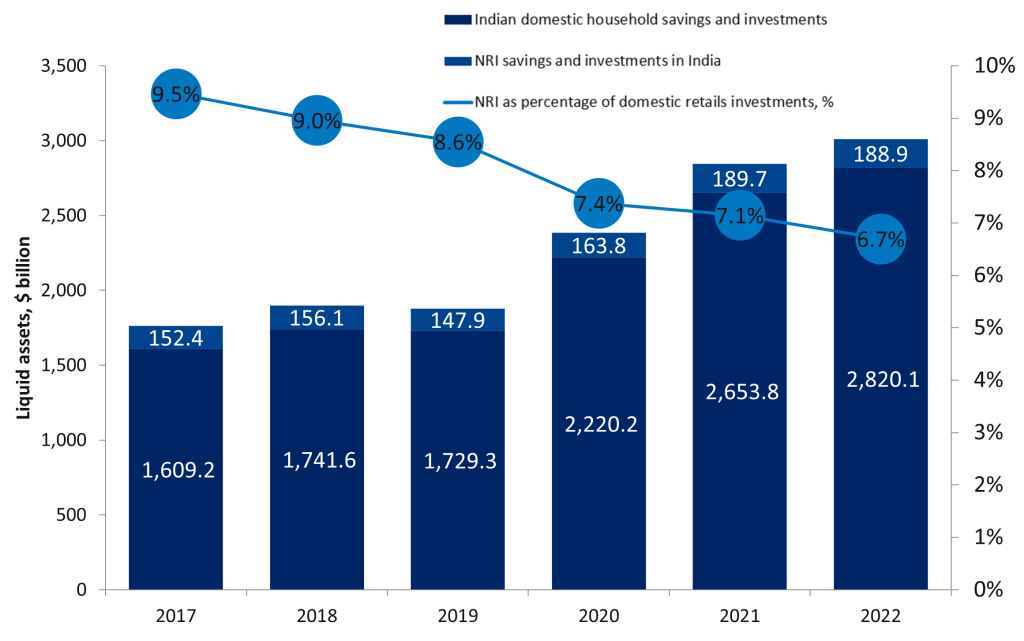

Both domestic Indian and NRI wealth grew notably amid the COVID-19 pandemic. According to the Reserve Bank of India and the Securities and Exchange Board of India, NRI savings and investments in India reached $188.9bn in 2022.

However, NRIs’ share of domestic retail investments dropped during the COVID-19 pandemic due to the forced repatriation of Indians along with the surging value of the local retail investor market.

NRIs’ wealth as a proportion of the overall retail Indian investment market, 2017–22

India is a lucrative destination for investment among NRIs, as they expect better returns from India compared to other countries.

Additionally, the country’s already stable economic performance has been improving, making NRIs more determined to capitalise on this opportunity by investing in India. Given rising resident wealth within India, many local Indian wealth managers have focused on the domestic opportunity. Yet they should not cede NRI wealth to international players, as these clients offer greater revenue potential owing to their more complex financial needs in comparison to Indian residents. NRIs are typically more diversified in terms of their investments and often require more financial advice, which translates to higher revenue for wealth managers.

Unsurprisingly, growth in the NRI space has attracted the attention of international players. Indian wealth managers’ more extensive local knowledge of a complex market provides them with an advantage. But domestic players often lack an international branch presence, which gives wealth managers based in NRIs’ country of residence a foothold to target these individuals. Widespread digitalisation following the COVID-19 pandemic – as well as growing uptake of robo-advice globally – offers Indian players an approach to follow. Indian wealth managers should invest in upgrading or launching digital investment platforms, with a particular focus on low fees, ease of navigation, and efficiency.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIf investing online is made suitably hassle-free and cost-effective, NRIs are likely to favor the familiarity and market knowledge offered by Indian wealth managers.