Technology is increasingly being incorporated within the wealth management industry, from robo-advisors to AI-enabled chatbots. However, the need for human financial advice will not be pushed to the side any time soon, according to GlobalData.

Stereotyping the younger generations as purely wanting digital services will only be detrimental to wealth managers. The UK’s Digital Integration in Wealth Management 2019 conference explored this topic in detail. Needless to say, the wealth managers in the room found joy in the reassurance that young, digital-savvy heirs to the throne will still require human expertise.

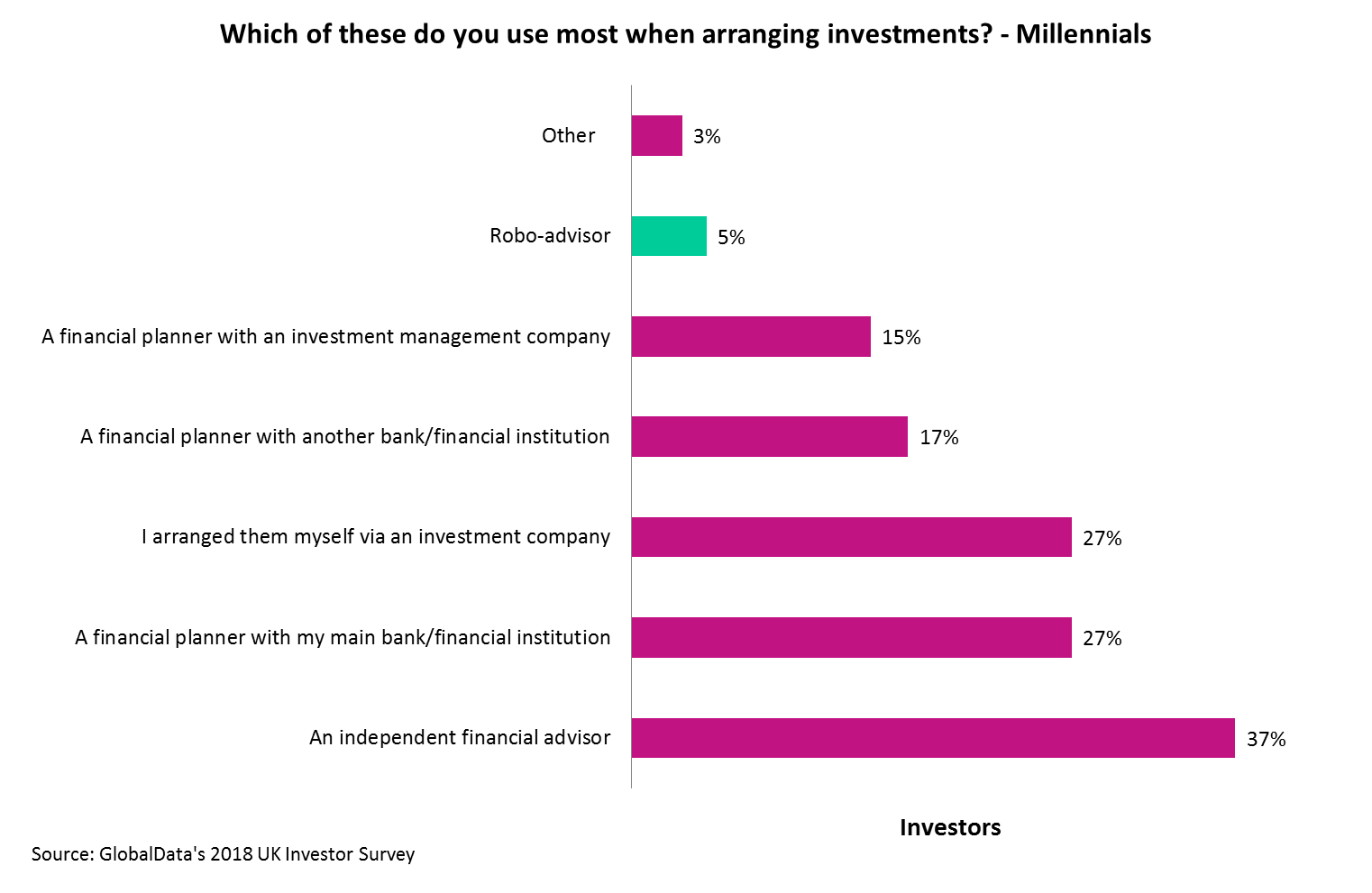

According to GlobalData’s 2018 UK Investor Survey, face-to-face communication still reigns supreme when arranging the buying and selling of investments – even among millennials. Email and telephone communication are in second and third place respectively. Meanwhile, only 5% of millennial investors favour robo-advisors when arranging their investments, with the majority still relying on a human planner or advisor.

Evidently, these digital natives are still seeking a human to collaborate with and gain valuable insight from – a need that cannot be met via a solely automated service. Besides, traditional wealth managers have experienced multiple recessions and periods of market volatility, proving they are able to weather a storm. With a potential market downturn on the horizon, who is to say that robo-advisors are ready to tackle the risks to client investments that come with it?

Wealth managers should not rest on their laurels, however, as automated investment services are set to grow in demand according to a majority of wealth managers surveyed in our 2018 Global Wealth Managers Survey. Furthermore, incorporating digital services provides advantages for wealth managers. A robo-advisor can reach new demographics such as the mass affluent, as well as offering operational efficiencies through automation of tasks.

Pigeonholing the next generation into a digital chamber is the wrong way to view millennials. Mobile investment apps are unable to cater to the emotional needs of humans relating to financial advice. A hybrid model is the best bet for the moment, and for the near future.