Wealth management firms are embarking on a digitalisation drive, in part forced by the emergence of increasingly sophisticated wealthtech firms challenging the established structure of the industry. From advanced digital platforms to robo-advisors and artificial intelligence (AI), there is an abundance of new technology reshaping both traditional advice and its delivery channels.

Robo-advisors have caused havoc for traditional wealth managers in recent years, providing a low-cost alternative for investors, pressurizing management fees, and attracting over 13% of the average European HNW portfolio. As such, these services are high on the wishlists of traditional wealth managers looking to expand their own offerings and reduce their competition in the process. 61.7% of those surveyed in GlobalData’s 2023 Global Wealth Managers Survey expect the consolidation trend to continue, with fewer standalone robo-advisors on the market in the next 12 months. This may restrict competition to some extent. Yet with the financial backing of large institutions behind them, this could facilitate the rapid development of robo-advisors, creating comprehensive wealth offerings at traditional managers in a single digital ecosystem.

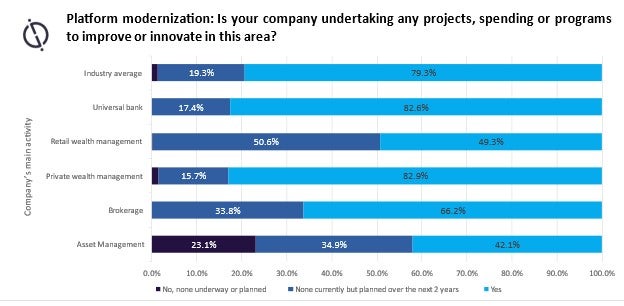

As demand for real-time visibility into investment options booms, state of the art digital channels are increasingly necessary to compete. Nearly 80% of industry players are undertaking such projects as per GlobalData’s 2023 Global Wealth Managers Survey, with nearly all planning to do so within the next two years. In addition, 60.2% indicated this was essential to remaining competitive by better serving their current client base and attracting new customers. The result of this will be increased servicing via digital channels and perhaps the expansion of wealth managers into less affluent wealth bands, with digitalisation providing a lower-cost channel to offer coverage for such investors.

Competitive pressures are also encouraging the integration of AI into wealth management due to its potential to cut costs and enhance the customer experience. According to GlobalData’s 2023 Global Wealth Managers Survey, 62% of respondents think that investments in AI and machine learning will allow them to more effectively service clients. This could be through internal use curating information for advisors – an approach Morgan Stanley recently adopted in partnership with OpenAI. It could also be through customer-facing chatbots lowering the workload of advisors and streamlining customer service. Additionally, 71.3% of wealth managers see investment in behavioral analytics as key to understanding the needs and wants of their clients. Such investments will fundamentally change the way in which wealth management services are delivered to clients and the structure of wealth management firms themselves – with streamlining or expansion possible with the effective man hour gains.

Overall, technological advancements across the board will shape wealth management in the coming years, with razor-thin fees increasingly limiting room for price competition. This is likely to fundamentally change the services offered by firms, especially for those in lower wealth bands, with the opportunity to streamline operating models and utilise intelligent digital channels. It will be important to maintain personal relationships between wealth managers and clients, which are key to building trust. But for menial decisions, access to digital services will likely be seen as a convenient alternative.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData