Although the incoming Trump administration is likely to roll back or stall key elements of the clean energy rollout in the US—as well as scrap various environmental, social, and governance (ESG) regulations and mandates—the impact on global private wealth managers’ strategy will be minor. Private wealth managers will continue to build up their ESG investing capabilities.

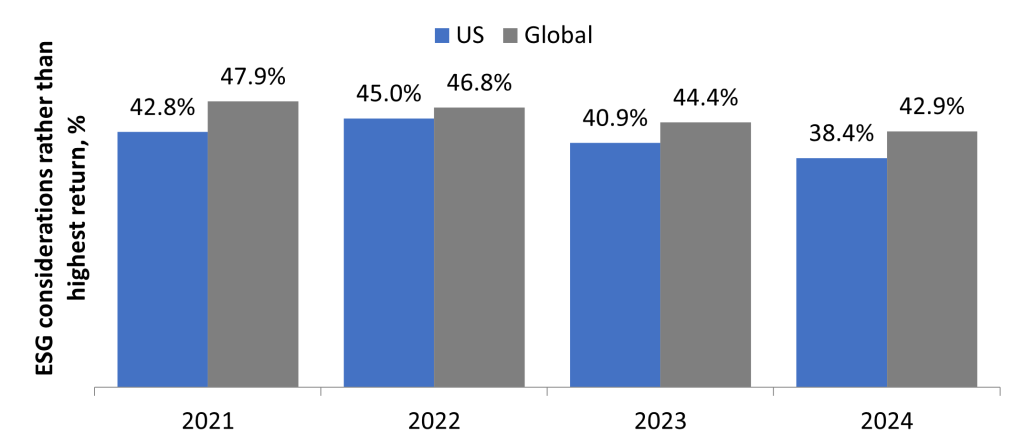

The importance of ESG investing compared to achieving the highest possible returns has been declining since 2021 across both the US and the world. Yet despite this trend, wealth managers have remained committed to the concept. Leading private banks such as UBS—with plenty of exposure to the US market —highlight the growth in ESG-related investments, with the group’s total sustainable focus and impact investing assets reaching $292.3bn at the end of 2023.

In term of how you approach your finances, which do you think is more important: ESG considerations or highest return possible? 2021–24

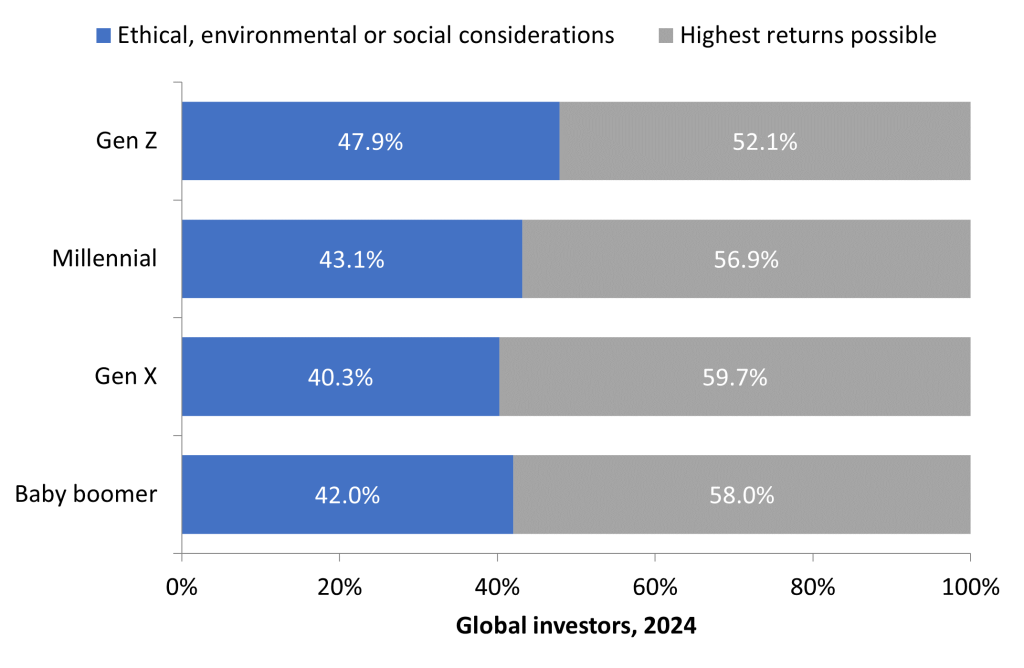

This is because of the long-term nature of their strategies, with ESG investing notably more important to next-generation investors. Going forward, Generation Z and millennials will form the mainstay of the wealth management market, rather than the rapidly diminishing baby boomer and even Generation X demographics.

President-elect Trump is a known skeptic regarding ESG initiatives, viewing them as an impediment to US businesses boosting their profitability and competing on the global stage. His return to office may ultimately see various ESG regulations repealed or discarded. Yet such moves are unlikely to have a significant impact on consumers’ attitudes and behaviors.

With this in mind, private wealth managers will continue to develop and promote their activities in the ESG and sustainable investment space in the hope of setting themselves up for capturing greater market share in five years’ time, a market shaped less by Baby Boomers and more by Gen Z.

Opposing priorities: Ethical, environmental, or social considerations vs. the highest returns possible

Andrew Haslip is the Head of Content for Wealth Management and Asia-Pacific (FS) at GlobalData

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData