DBS recorded impressive growth in the first half of 2023 due to remarkable expansions of its wealth income. This trend was fuelled by new money and wealth inflows originating from Asia-Pacific.

In the first half of 2023, DBS saw a notable surge in its wealth management assets under management (AuM) to SGD320bn ($241bn), representing a 9% increase from last year that was driven by new money inflows of SGD12bn ($9bn) within the respective sector.

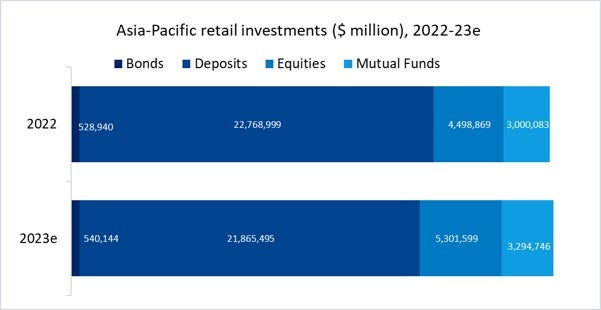

With the rapid expansion and increasing prosperity of Asia-Pacific, demand for financial services and professional investment management has grown significantly. As per GlobalData’s Retail Investments Analytics, the total wealth of Asia-Pacific is set to increase by 1% in 2023, with all asset classes except deposits set to grow compared to 2022. Notably, mutual funds and equities will record respective year-on-year growths of 9.8% and 17.8% in the region.

This growth represents a great opportunity to generate wealth in the Asia-Pacific region. This is perhaps best evidenced by DBS, whose wealth management income rose by 53% year-on-year in H1 2023, reaching $1.6 billion. This growth was mostly driven by revenue from investment product sales and bancassurance in Asia-Pacific.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData