The uncertain Covid-19 environment has caused many businesses to rethink their strategies and models. It is a great opportunity to change sectors for the better, but will that happen, or will private banking see the ‘old normal’ in its future? Patrick Brusnahan reports

Wealth management is in “unchartered waters”. This is according to the World Wealth Report 2020 from Capgemini which is, as is most of the world, dominated by the impact of Covid-19.

Anirban Bose, financial services strategic unit CEO and group executive board member at Capgemini, states in the report: “In the face of today’s extraordinary uncertainty, forecast, models and assumptions may merit review and potential adjustments. Wealth firms that revisit their cost structure and distribution channels can build more resilient and agile business and operating models.

“The unpredictable period may also present opportunities to reach underserved or new investors, as demand for advice tends to increase during periods of market turbulence and the strategic case for sustainable investment advances.”

He adds: “Now, as wealth management firms are hard pressed to get the most bang from pressurised budgets, it will be wise to determine which critical capabilities (such as hyper-personalisation and value-added services) have the most potential to boost client experience and firm profits.”

The opportunity to change is there, but is the return? Speaking to PBI, Elias Ghanem, global head of market intelligence at Capgemini Financial Services, says: “The opportunity for change had presented itself even before the pandemic, and the pandemic situation has accelerated the need for grabbing this opportunity. In fact, the novel coronavirus disruption has made sure that business, as usual, may no longer be pragmatic or even possible.

“The opportunities need firms to comprehensively assess and reinvent their business for viable post-pandemic success and contribution.”

He adds: “Even as wealth executives’ immediate focus may be on business retention, building capabilities – both now and in anticipation of recovery – may pave the way to future opportunities and new revenue streams.

“As analysed in the report, successful firms will be those that can collaborate with the wealth management ecosystem players to build synergistic relationships to quickly meet the ever-evolving high net-worth clients’ demand around easy to access personalised information and tailored investment strategies.

“Also, as giving back gains even greater significance in the post pandemic world, sustainability and ESG investments are on the minds of firms and clients. Covid-19 may profoundly affect consumer behaviour – making personalised engagement a requisite norm and opening new opportunities or challenges to wealth firms now and into the future.”

State of wealth

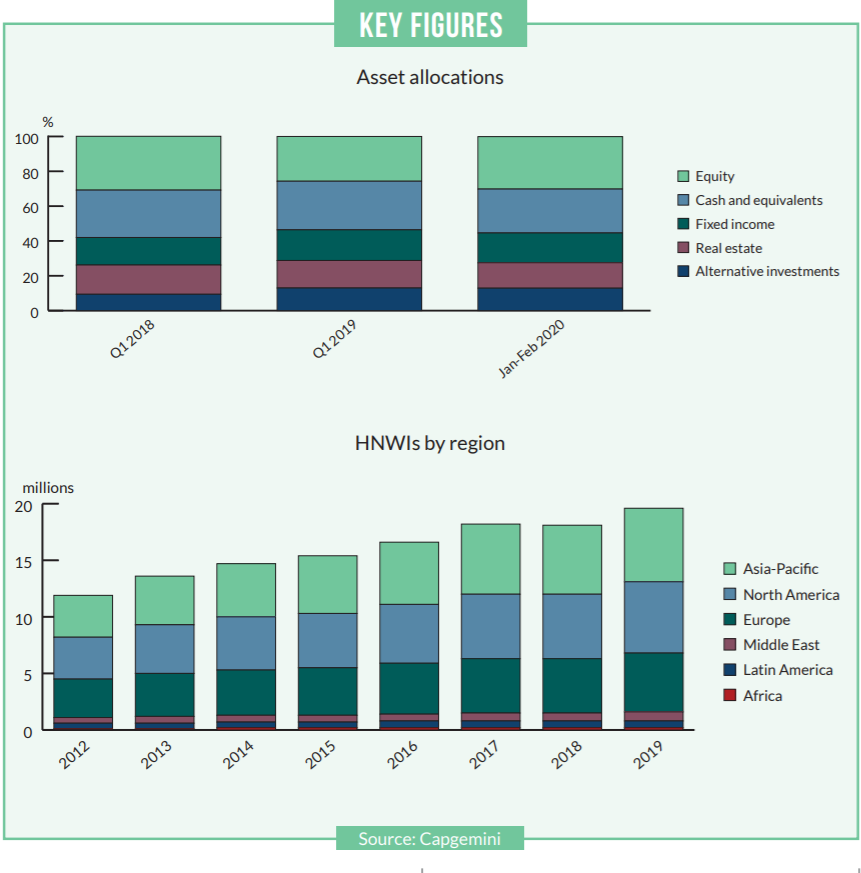

2019 witnessed 8.8% growth in the HNWI population, and global wealth grew by 8.6%. Developed markets led the way for the first time since 2012; North America recorded 11% growth; however, the UHNWI segment increased its population by 9.1% as its wealth growth stumbled a little at 8.2%.

According to the report, 2020’s unpredictability has suppressed HNWI risk appetite. At the same time, the Covid-19 investment environment is likely to increase client expectations on value delivered for fees charged. Certain product offerings and value-added services were highlighted:

- ESG investments were predicted to likely take on more significance for HNWIs and wealth management firms;

- Proactive care to clients’ unique needs at certain transition points in their life and financial journey could help tap future growth segments, and

- Hyper-personalisation aided by artificial intelligence (AI) and analytics.

The report also states: “In the face of today’s unprecedented uncertainty, wealth firms that revisit their cost and clients’ fees structure and distribution channels can build more resilient and agile business and operating models.

“Firms can maximise the impact of their investments through a laser focus on capability building to identify the critical 20% of the value chain that impacts 80% of CX and profitability.”

According to the report, Covid-19 and its after-effects wiped out over $18trn from global markets in February and March 2020. Markets recovered slightly in April, but predictions show a decline of 6-8% in global wealth by until the end of April 2020 compared to the end of 2019.

For the first time since 2012, Asia-Pacific did not lead global HNWI wealth growth: it was North America in front, accounting for 39% of global HNWI population gains and 37% of HNWI wealth growth, or $2.2trn.

In the US, the HNWI population spiked by 11% in 2019, compared to a measly 1% in 2018. In Canada, both the HNWI population and wealth increased by more than 8% in 2019.

For Europe, the HNWI population and wealth growth were both approximately 9%. Despite uncertainty due to Brexit throughout 2019, the UK witnessed HNWI population and wealth growth of more than 6%.

Asia-Pacific fell behind the average (9%) global HNWI growth rate slightly at 8%. However, Key Asian markets such as Hong Kong, China and Taiwan experienced double-digit growth.

The report states: “Other major Asian markets – India, South Korea and Singapore – recorded weak progress in 2019, which led to sub-par growth in HNWI population and wealth for the entire region. Anaemic performance in these markets was the result of economic slowdown and weakening local currencies.”

Bigtech

A sector that received rave reviews in the report was bigtech. When respondents were asked if they were to employ a firm such as Google or Amazon for wealth management, 74% said yes. In addition, 94% said they were likely to switch firms in the next 12 months; in Japan, that figure rose to 100%.

Ghanem says: “In the past few years, bigtechs globally have entered the broader financial services industry, beginning with payments and then moving into areas including loans and insurance.

“Bigtech entry into wealth management has been less pronounced because of formidable barriers to entry, with a few exceptions such as Alibaba and Tencent (which already have positions in wealth or investment management firms).

“Bigtechs have many differentiators that may spur them to consider wealth management market entry, notably technology capability (across data, analytics and speed), efficiency and agility, existing penetration and knowledge of clients from their traditional businesses, and the relatively low cost of their services in the main. There is emerging consensus among industry experts and wealth management firm executives which broadly surmises that bigtech market entry is on the horizon.”

Ghanem adds: “Bigtechs are not expected to take over the industry and enter as full-service wealth management firms – as they face lack of experience across key aspects such as regulation, ability for in-person advisory and so on – but they are expected to act as both collaborators and competitors across different parts of the value chain. One such possibility is for bigtechs to capture the mass affluent or next-gen market through digital and robo advisory-based models.

“Regardless of the bigtech entry model, wealth management firms must transform the way they invest for the future, to ensure flexibility and innovation to deal with whatever new business models emerge as customers are already looking for a change.”

Ghanem concludes: “As seen in the World Wealth Report 2020, a much higher percentage of HNW clients believe that bigtechs are more likely to provide excellent service on key touchpoints than the incumbent wealth management firms (around 30% versus around 12%) especially while delivering personalised information or services.

“As a result, while 74% of HNWIs said they are willing to consider bigtech wealth management offerings in case they offer them, the number jumps to 94% among those who say they may switch their primary wealth management firm in the next 12 months.”