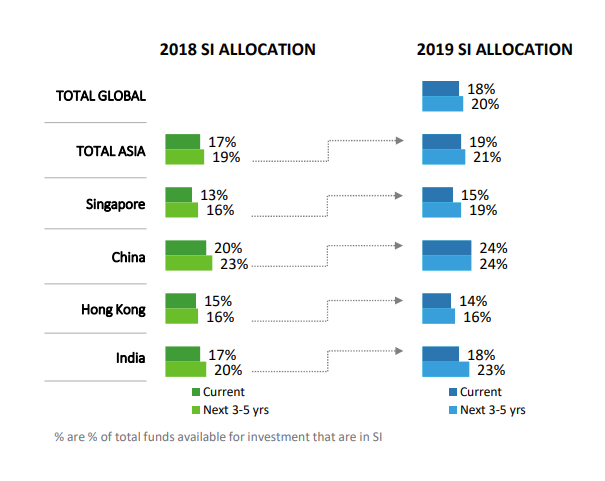

The average portfolio allocation to sustainable investments in Asia has reached 19%, according to a new report from Standard Chartered.

But it is China which leads the way when it comes to sustainable investments, according to the report, ‘Asia Sustainable Investing Review 2019’.

Nearly a quarter of the average Chinese portfolio is allocated towards sustainable investments, which Standard Chartered defines as those that integrate environmental, social and governance (ESG) considerations.

Some were even more generous: 29% of Chinese investors made more than 35% of their investments sustainable. Just 6% of Indian investors did the same, the next nearest nationality.

However, most of the 416 HNWIs surveyed for the report said that “more information about the availability of sustainable investing opportunities,” would help them to increase their allocation.

Commenting on the results, Didier von Daeniken, global head of Private Banking and Wealth Management at Standard Chartered said banks could do more to address this: “Some misconceptions still exist, and this is where banks play a crucial role to educate and help investors overcome their barriers to investing for impact.”

There is an increasing concern of empty promises when it comes to ESG investing. Many wealth managers hear a lot of talk but see less action.

Standard Chartered calls these investors “Aspirants, investors who claimed to be engaged in sustainable investing, but have not started yet”. There are 16% of these in Asia, according to the report. Then there are 9% who are completely disengaged in sustainable investing.

Other surveys have picked up on this. One conducted by UBS last year found that while 65% of wealthy investors are motivated by sustainable investments only 39% hold such assets in their portfolios.

Another study last year by KPMG, CLP and the Hong Kong Institute of Chartered Secretaries (HKICS) said around 70% of business executives of Hong Kong-listed companies acknowledged ESG’s value in their businesses. However, just 37% incorporated them into their core strategies.