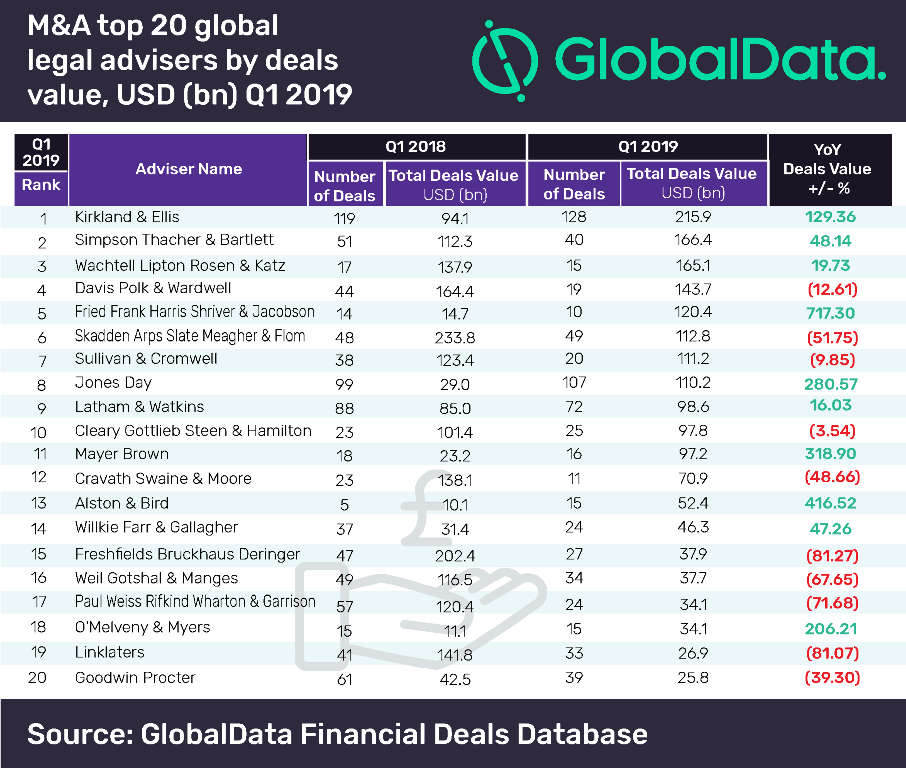

Kirkland & Ellis was the leading financial adviser globally for mergers and acquisitions in Q1 2019, according to GlobalData.

The American law firm advised on 128 deals worth $215.9bn (up 129% year-on-year) including the biggest transaction of the quarter: Bristol-Myers Squibb’s acquisition of Celgene for $89.5bn.

Kirkland & Ellis ranked in 12th position in GlobalData’s full-year ranking of legal advisors for global mergers and acquisitions.

GlobalData has published a top 20 league table of legal advisers ranked according to the value of announced deals globally.

Simpson Thacher & Bartlett took second place with 40 transactions worth $166.4bn (up 48.1% year-on-year).

Ravi Tokala, financial deals analyst at GlobalData, said: “All the top five positions in the legal adviser league table are held by the US-headquartered law firms, clearly indicating the kind of supremacy the US-based advisers command in global M&A sphere.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataWachtell Lipton Rosen & Katz was in third place having advised on 15 transactions worth $165.1bn (up 19.7% year-on-year) and Davis Polk & Wardwell took fourth place with 19 deals worth $143.7bn (down 12.6% year-on-year). With ten deals worth $120.4bn (up 717.3% year-on-year) Fried Frank Harris Shriver & Jacobson took fifth position in the league table.

In terms of deal volume, Kirkland & Ellis topped the table with 128 deals, followed by Jones Day with 107 deals worth $110.2bn.

In Q1 2019, 13,576 deals were recorded globally, marking a 37% increase year-on-year, and a 3.7% rise from Q4 2018.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website