A string of scandals in the Australian wealth market are causing some consumers to renew an interest in robo-advisory platforms. GlobalData Financial Services reviews the past week.

Another week, another horrible headline in the press for Australian banks and wealth managers. IOOF is the latest wealth manager in Australia to be struck by scandal, with both its managing director and chairman stepping aside to fight APRA’s move to have them disqualified from managing superannuation. Regardless of the outcome of the proceedings, the damage to IOOF and to public trust in the financial services industry will have significant long-term implications for how Australians invest.

IOOF is strenuously disputing the allegations of conflicts of interest but the damage has been done both to IOOF, with its share price down over a third, and wealth managers more generally. Superannuation has a prized place in the heart of many Aussies and so allegations of misuse of client money in this area are particularly damaging. APRA’s accusations – coming as they do after a long string of banking- and wealth-related scandals unearthed by the Royal Commission into Misconduct in Banking, Superannuation and Financial Services – give the impression that the entire industry is suffering from a conflict of interest and corruption.

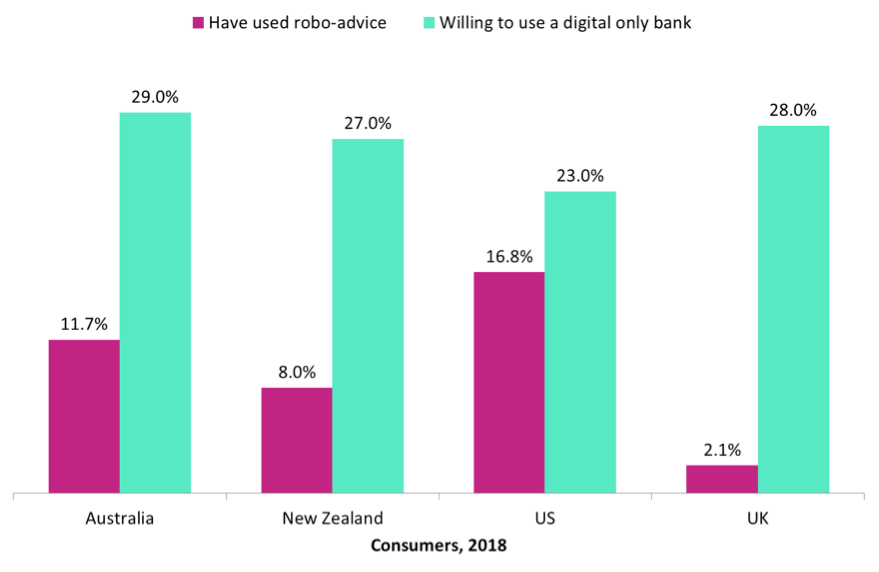

Similar brand damage from the scandals of the global financial crisis caused lasting harm in other markets such as the UK and the US. The rise of robo-advisors such as Betterment, Wealthfront, and Acorns in the US and a host of neo-banks like Atom, Monzo, and Starling in the UK was facilitated by a collapse of faith in established banking brands. The exact same thing is under way in Australia and by association New Zealand, as many of the same brands are in operation on either side of the Tasman Sea.

Consumer trends have shifted – all that remains is a push from the market

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe clutch of neo-banks waiting in the wings in Australia will have no better time to launch recruitment drives, while a range of robo-advisors, none of which have yet broken out into the mainstream, will have the best conditions yet to draw in AUM.

Incumbents need to act fast to shore up tarnished brand images. As of yet there is no indication that consumers are keen to switch. But all it will take is a sudden change in interest rates, putting attractive APRs for savings out into the market (unlikely in the short term to be sure), or a big downturn in the share market causing portfolio values to tumble (already underway by some measures), to galvanize the market. With these consumer trends already in play, disillusioned consumers will bite the bullet and switch to these new untested but unsullied providers.