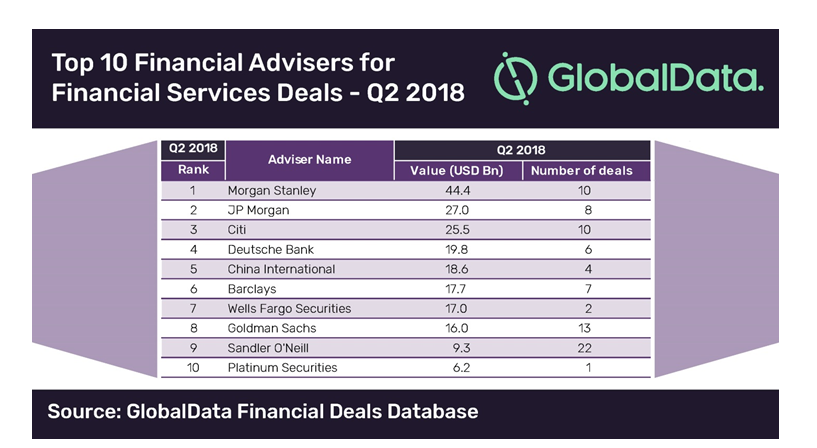

Morgan Stanley has topped the latest financial services deals advisers ranking of top 10 financial advisers for the financial services industry for Q2 2018, compiled by leading data analytics company GlobalData.

In Q2 2018 the bank advised on 10 deals worth a combined $44.4bn, followed by JP Morgan with eight deals worth $27bn and Citi with 10 deals valued at $25.5bn.

According to GlobalData, which uses its tracking of all merger and acquisition, private equity/venture capital and asset transaction activity around the world to compile league table, advising on the industry’s top three high-value deals during the quarter fetched the top rank for Morgan Stanley.

The big deals of the quarter

Capital One’s sale of $17bn worth of mortgages to DLJ Mortgage Capital, Ant Financial’s $14bn series C fundraising and Barclays Bank’s proposed acquisition of Bradford & Bingley’s $7.4bn assets were the top three deals registered in the financial services industry during Q2 2018.

Global financial services sector witnessed a huge jump of nearly 124% in the deal value, from $39.9bn in Q2 2017 to $89.2bn in Q2 2018. In contrast, volumes rose moderately from 701 to 864 during the quarters in review, marking over 23% growth.

All deals announced count towards the league table compiled by GlobalData.

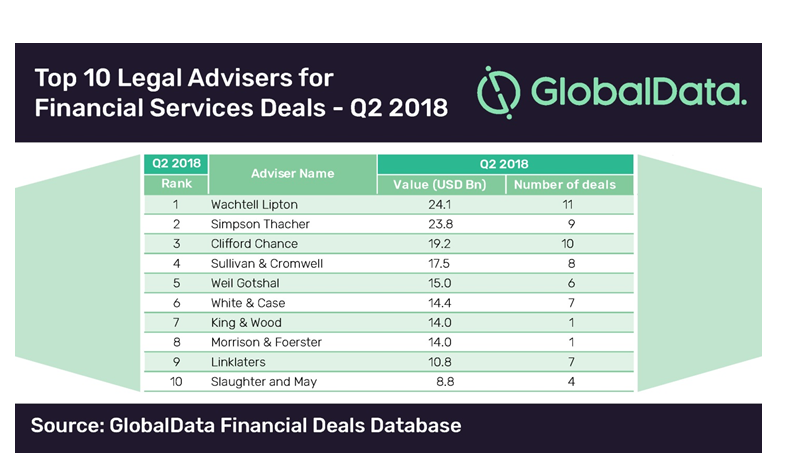

Wachtell Lipton leads M&A legal advisers pack in financial services

Wachtell Lipton, Simpson Thacher and Clifford Chance are the top three law firms advising on financial services sector deals in Q2 208.

Wachtell Lipton is advising on deals worth a combined $24.1bn, followed by Simpson Thacher advising on deals worth a combined $23.8bn