The Chinese private banking industry is notoriously difficult to penetrate – but wealth managers that are aware of the local makeup of the HNW market are also likely to find it highly profitable, according to recent research by GlobalData Financial Services.

Wealth managers in China will find business owners a lucrative and sizeable market, with over 61% of HNW investors having sourced their wealth through first-generation entrepreneurship or business ownership.

This is a key message from the GlobalData report, Wealth in China: HNW Investors 2017.

The most prominent industries from which HNWIs have amassed wealth are financial services and real estate.

Expatriates also represent a sizable proportion of the resident HNW population in China, and wealth managers reaching out to expats from the US, Australia, and Hong Kong will encounter few difficulties in picking up new business, says GlobalData.

Entrepreneurial spirit runs deep in China, and the number of entrepreneurs is growing at an exponential rate, says the report. Individuals who have accumulated their wealth from first-generation entrepreneurship and family businesses together represent a noteworthy 61.3% of the local HNW population, and GlobalData expects this proportion to increase as the government continues to support business owners.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIn 2015, Premier Li Keqiang called for “mass entrepreneurship and innovation”, and declared it the leading agenda of the country’s national economic strategy. China has also become the world’s second-largest producer of ‘unicorns’ – non-listed companies valued at over $1bn. Wealth managers would therefore do well to design product portfolios accordingly. For example, products focusing on cash management will be appreciated by Chinese HNW business owners as they are well suited to their often irregular income streams.

Investment style

Chinese HNWs typically use fewer than three wealth managers. However, investors also allocate significantly smaller proportions of wealth to their main manager, making China a competitive country in which to operate. Decisions on how many wealth managers to use can be influenced by considerations such as price sensitivity, portfolio diversification, and differing areas of expertise.

Financial markets in China have been exceptionally volatile in the past two years, resulting in portfolio losses for investors. Given that discretionary mandates are dominant, wealth managers are likely to take the blame if expected returns are not met. Consequently, they will be more inclined to manage an increased proportion of their fortune themselves, or move to competitors. To avoid increased churn rates when markets turn sour, wealth managers have to make relationship-building a priority.

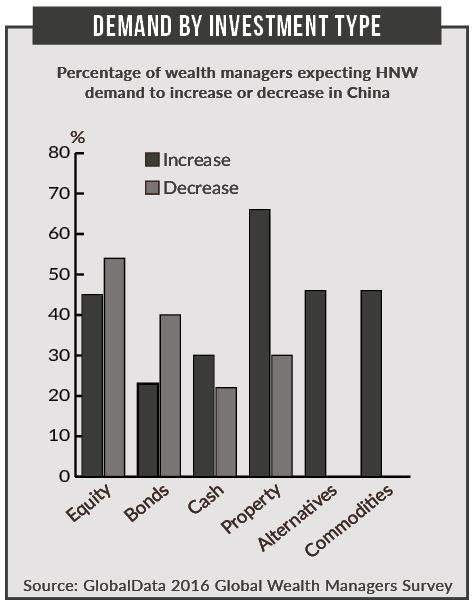

Access to sophisticated investment products only available through advisers also represents a strong draw for HNW investors to seek professional advice. Data from GlobalData indicates that an above-average 11.6% of HNW wealth is allocated to alternatives, and demand for this asset class is forecast to rise significantly over the next 12 months. Wealth managers that are able to provide access to more sophisticated investment products will therefore be at a distinct advantage.

While current demand for execution-only and automated investment services is significantly lower, wealth managers cannot afford to ignore these opportunities – not to mention the threats they pose.

New online-only financial services providers such as Alibaba, Tencent and Baidu have become extremely popular over the past few years, and GlobalData says the majority of market participants agree that wealth managers should invest in automated investment services to complement their offering. However, only half of HNW wealth managers offer this type of service in China, suggesting a potential opportunity.

GlobalData suggests three key success factors for wealth managers in China:

- Target expats: The Chinese HNW market has a growing expat component, and wealth managers need to be able to onboard these highly sought-after clients. This requires facilities that allow the onboarding process to begin remotely via a foreign branch if possible, or via partnerships with relocation services.

- Integrate automated services: Online-only services have grown rapidly in popularity, with a strong rise in demand for automated investments expected in the next two years. Providers should integrate these services into their propositions.

- Offer private equity investments: A desire to further diversify portfolios and future capital-appreciation opportunities are driving demand for private equity investments, which means that providing access to sophisticated investments is essential in China.