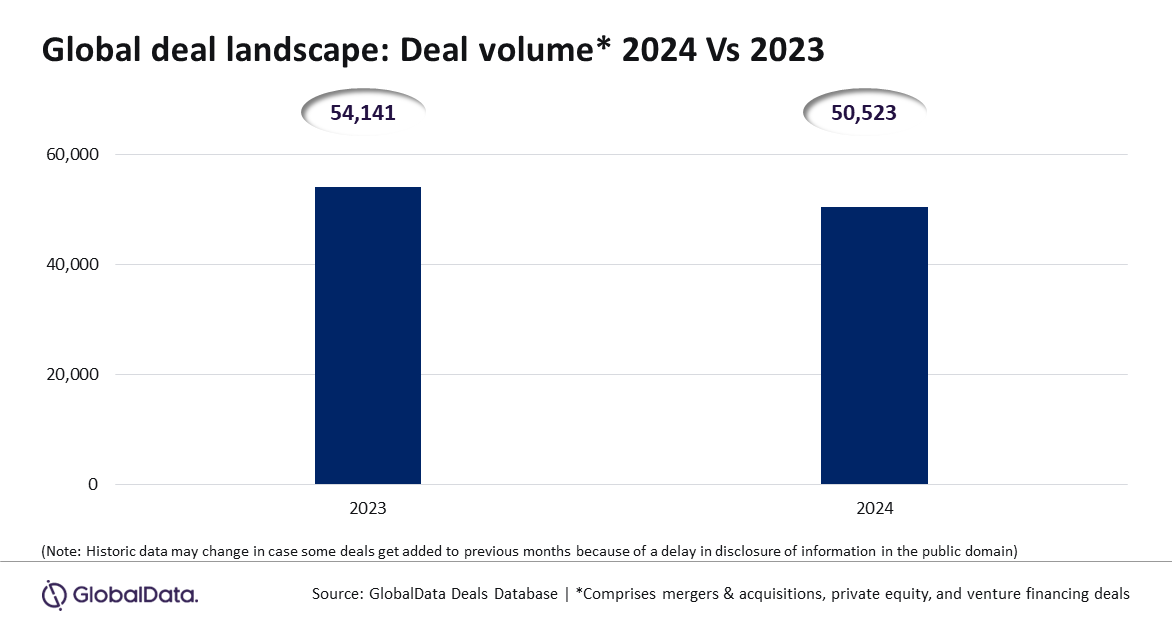

A total of 50,523 deals across mergers & acquisitions (M&A), private equity, and venture financing were announced globally during 2024, reflecting a 6.7% year-on-year (y-o-y) decline from 54,141 deals announced in 2023. Despite the overall downturn, certain markets demonstrated resilience, highlighting the nuanced dynamics of the global deal-making landscape, according to GlobalData, publishers of RBI.

Aurojyoti Bose, Lead Analyst at GlobalData, said: “Even though all the regions and all the deal types registered a decline, the impact varied widely with some experiencing massive double-digit fall in deal volume while some witnessing marginal declines. Notably, some countries registered improvement in deal activity during the year.”

An analysis of GlobalData’s Deals Database revealed that of all the deal types, venture financing deals saw the highest y-o-y decline of 17.2% during 2024 while private equity deal volume fell by 2.1% and the number of M&A deals decreased by only 0.4%.

North America and South and Central America saw their respective deal volume fall by 10.6% and 15.2% y-o-y in 2024, whereas Europe and Middle East and Africa witnessed decline in deal volume by 6.7% and 4.7%, respectively. Meanwhile, Asia-Pacific showcased relative resilience compared to other regions with its deal volume registering a much lesser decline of 1.4% during 2024 compared to the previous year.

Bose added: “Meanwhile, the trend remained a mixed bag among the different markets with some experiencing subdued deal activity while some registering growth in deal volume.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataFor instance, the US, China, Canada, Germany, France, Italy, Spain, the Netherlands, Sweden, and Singapore, experienced y-o-y decline in their respective deal volume by 10%, 20.8%, 15.3%, 9.7%, 17.9%, 3.7%, 9.6%, 13%, 8.8% and 13% during 2024 compared to the previous year. However, the UK, India, Japan, Australia and South Korea witnessed improvement in deal volume by 0.8%, 13.7%, 30.2%, 6.7% and 8.2%, respectively, during 2024 compared to 2023.

Bose concluded: “Overall, while global deal activity experienced a downturn in 2024, the landscape remains highly dynamic, with certain markets showing resilience and even growth. This mixed performance underscores the complex nature of the current deal-making environment, where regional and sectoral variations continue to drive divergent trends in M&A, private equity, and venture financing.”