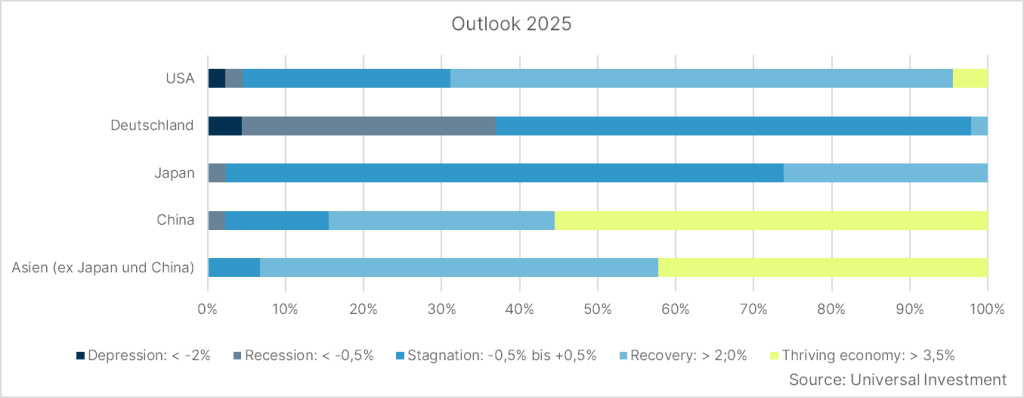

The majority of wealth managers predict an upturn in the US and Asia despite potential hurdles in 2025.

This is according to research from Universal Investment and its survey of wealth managers, which also predicted recession of stagnation for Europe and Germany.

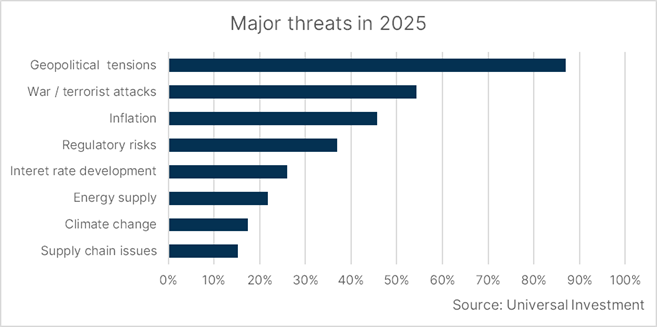

Respondents also forecast investment risks stemming from geopolitical tension (87%) and wars and terrorist attacks (54%). Inflation was also an issue at 46%.

However, climate change was near the bottom with a mere 17%.

With regards to asset classes in 2025, wealth managers were overweight in developed markets, with an ideal equity allocation of of more than 43% and almost 22% in fixed income.

Moreover, emerging market equities should account for just under 10% and emerging market fixed income for just over 5%. Respondents recommend a 5.5% allocation in real estate, however just over 4% of the total allocation should go towards alternative investments.

By comparison, the recommended allocation to gold and precious metals is quite high, at 7.7%.

Marcus Kuntz, Head of Sales & Fund Distribution at Universal Investment, said: “The majority of the survey respondents are independent wealth managers who have a significant advantage: they are not bound by investment guidelines or house views that large fund houses must follow. In previous surveys, these managers often demonstrated strong foresight in identifying promising asset classes and investment themes. For 2025, they favour healthcare and pharmaceuticals. As a fund services platform, we look forward to seeing if their predictions will once again prove to be accurate.”