Within the next decade, nearly one million households in the UK will have several generations retiring at the same time, according to a recent St. James’s Place study.

As a result, retirement income is anticipated to last for several generations, which forces many people to reevaluate their retirement strategies.

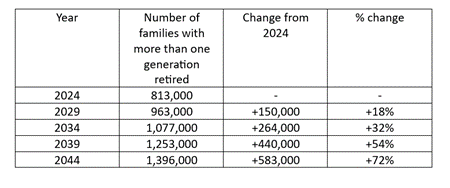

By 2029, there will likely be 963,000 families with an additional retired generation, up from the present total of 813,000.

This trend is expected to become increasingly dramatic over time, with an 18% increase over current estimates.

By 2044, it’s estimated that over 1.4 million families would have more than one retired generation.

The growth rate of multi-retiree families is accelerating

SJP’s data also revealed that multi-retiree families are growing quicker than expected.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataCurrently, there are 813,000 households with an additional retired generation, which is 100,000 more than was expected in 2018, when it was speculated that there would be 704,000 families with more than one retired generation by 2024.

There is no indication that this tendency will end, as it has increased from the 2018 estimates. More than one generation of elderly families will make up between 60,000 and 100,000 more households over the course of the next 20 years.

Appetite for retirement income is rising

Future retirees prioritise providing financial support to family members, with 55% expecting to do so in retirement, compared to 37% of current retirees.

In order to support future generations financially, future retirees plan to pay for childcare (14%), purchase a home or settle a mortgage for someone (16%), or cover daily living expenses (22%).

Moreover, other usual methods that people anticipate assistance are with holiday and school expenses (14% and 14%, respectively).

Several future retirees intend to take major action, including:

- Working in retirement to supplement their income (14%);

- Reducing spending on essentials (12%);

- Delaying retirement in order to build up a bigger pot (12%);

- Reducing the amount, they are able to pass on in inheritance (9%);

- Drawing upon additional sources of income before they had originally planned to do so (8%), and

- Accessing pension pot early to provide for others (8%).

Claire Trott, divisional director for retirement and holistic planning at St. James’s Place, stated: “With people living longer, retirement provision more and more becoming the responsibility of the individual, and the economic landscape evolving, the way we need to think about planning for the future has fundamentally shifted. The next generation of retirees can’t expect to follow the same path as those currently in retirement.

“There is a lot of pressure on people’s finances currently, and so building sufficient funds for your future whilst also supporting other generations may not be the priority and can feel daunting. In addition to this, future retirees are increasingly expecting to financially support others once retired, and retirement income is having to stretch in multiple directions. In order to do this, our approach to retirement planning must change. Putting in place the right plans at an early stage will allow greater opportunity to build wealth over time and leave behind as much as possible when you’re gone, without making unnecessary sacrifices along the way. Seeking professional advice can help you navigate these plans, giving you and your loved ones more security in future.”