The anticipated growth in Indian household wealth highlights the need for upgrades and expansion within the domestic wealth management sector in India. Only then will local providers be able to effectively handle the evolving needs and diverse investments of both resident and non-resident Indians.

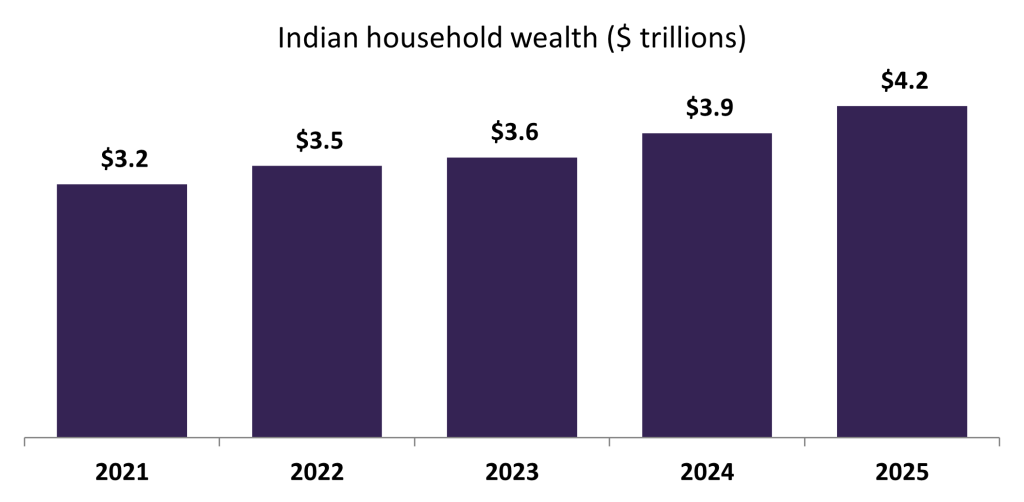

As per GlobalData’s Wealth Markets Analytics, India’s household wealth is expected to grow rapidly at a rate of 8.6% in 2024, before crossing the $4trn mark in 2025. This growth trend will be driven by several factors. Most notably, domestic stock markets are projected to continue their bull run. The Indian stock market achieved a major milestone in 2023 as the benchmark NIFTY 50 index reached an all-time high of 19,425 in November 2023, outperforming many of its international counterparts.

Additionally, the Reserve Bank of India decided to maintain its repo rate at 6.5% and adopt an accommodative stance in December 2023. This approach is expected to boost liquidity and foster further investment in stock markets and mutual funds.

The growing value of Indian household savings will require a major expansion in the size and sophistication of the local wealth market—as will individuals’ increased exposure to and interest in investment products such as stocks, ETFs, and mutual funds rather than simple deposits. In 2024, expect local wealth managers to announce big expansion drives even as international providers increasingly eye the market for new clients.