Participants in the Vyzer funding included iAngels, Guy Gamzu, MonetaVC, Jonahtan Kolber and Rafi Gidron.

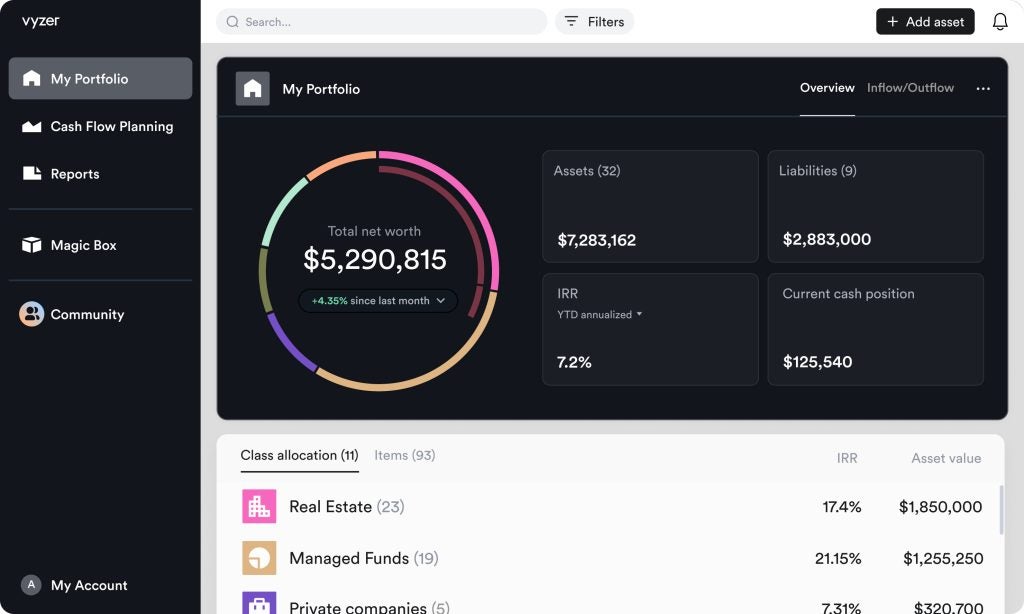

Leveraging AI, Vyzer transforms data into wealth-building strategies and grants investors access to a unified portfolio view.

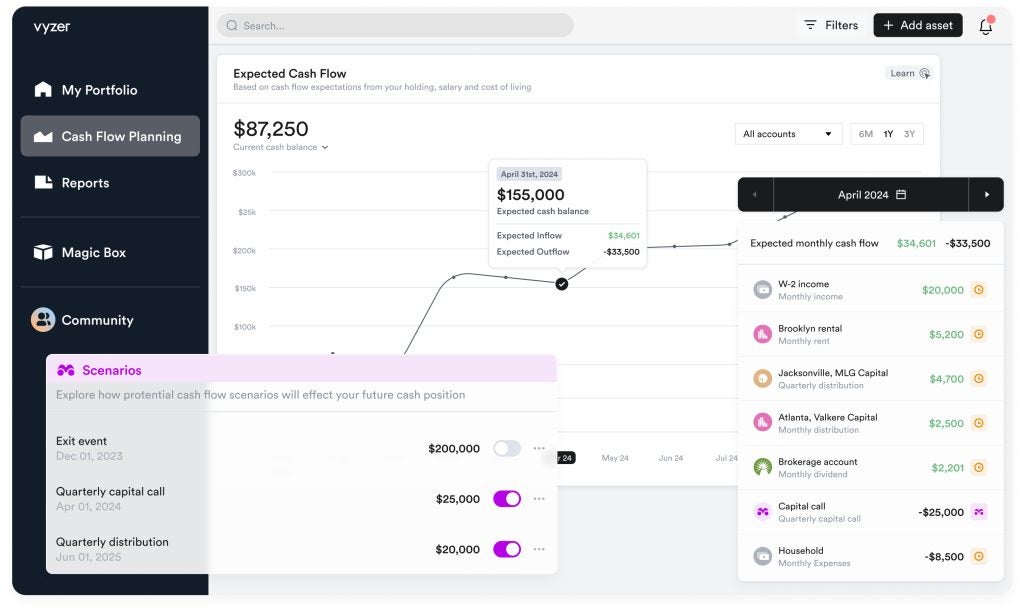

The solution entails financial analysis, advanced planning, tracking, automated data management, insightful analytics, peer benchmarking, and forecasts. All of these are also accessible through a single dashboard.

Powered by advanced AI and sophisticated algorithms, Vyzer improves cash flow management and investment foresight, removing the need for manual data entry and reducing expenses.

Furthermore, its peer benchmarking tool, which uses the platform’s AI to provide clients with insight into investment strategies, fund managers, and similar investors’ activities. Users can then use this to make informed investment choices and anticipate financial trajectories.

Reaction to Vyzer funding

“This investment marks a significant milestone for Vyzer, enabling us to enhance our platform and expand our reach,” said Vyzer Co-Founder and CEO Litan Yahav. “Vyzer is making billionaire wealth management back-office capabilities accessible to everyday investors.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“The funds will enable us to enhance our platform’s AI capabilities, develop new features, and broaden our market presence. Our ultimate goal is to simplify and streamline complex wealth processes for our customers, equipping each member with greater insights and control. This, in turn, empowers them to maximise their investment potential and foster wealth growth.”

“High-net worth individuals are increasingly gravitating towards private investments – from real estate and start-ups to private equity. However, the lack of digitisation in the management of these alternative investments presents significant challenges when it comes to achieving a holistic overview of their portfolios. Vyzer’s solution provides investors with broad and transparent visibility into their portfolios. It allows them to capitalise on the ever-growing investment landscape by making informed and timely decisions, and it enables them to effectively scale their portfolios at an affordable cost,” said Shelly Hod Moyal, founding partner of iAngels.

“iAngels is thrilled to partner with Litan Yahav and Tomer Salvi, who prior to Vyzer, successfully founded and sold their first company Segoma, began investing and experienced first-hand the market need for the next generation of digital investment management solutions.”