Markets had been pricing in a 61% chance of a larger 50 bps increase similar to the Bank’s move at its July meeting, while economists’ consensus expectation was for a 25 bps hike. Rufaro Chiriseri writes

This split was also evident in the voting by the nine-member Monetary Policy Committee (MPC). Three MPC members dissented, with two voting for a 50 bps hike while one voted for no change. The BoE maintained its guidance that “if there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required.”

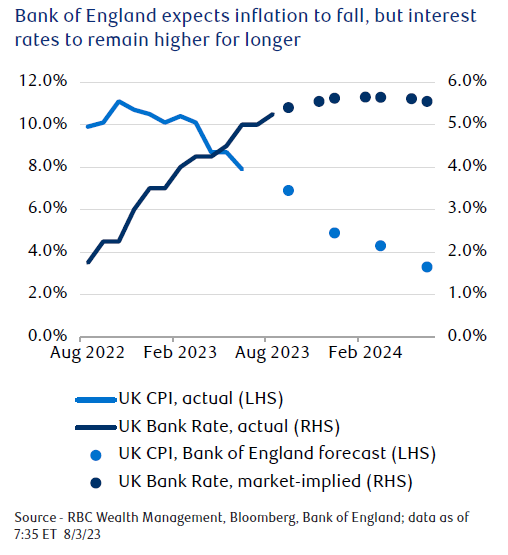

Furthermore, new guidance stated that “the MPC would ensure the Bank Rate was sufficiently restrictive for sufficiently long …,” suggesting interest rates could remain higher for longer. The market read the policy statement as less hawkish and an indication that a hike to 5.75% may not be necessary after all; market pricing of the terminal Bank Rate subsequently fell from 5.80% to 5.70%. The pound declined roughly 0.5% against the U.S. dollar, and 2-year Gilt yields initially fell by 15 bps before settling around 4.90%.

Our base case is that the terminal rate will be 5.50%, provided the two wage growth and services inflation data reports between now and the BoE’s September meeting are in line with the August Monetary Policy Report (MPR). However, if the data come in above target levels, that view could be at risk, with a greater possibility of further tightening to 5.75%.

The August MPR cut growth forecasts over the next two years compared to the May MPR, while projecting the economy would narrowly avoid a recession. The latest report also expects inflation to drop to 5% by year’s end, but includes a larger upward revision to 1.7% from 1% for 2025. Interestingly, the central bankers do not appear to be putting much faith in their forecasting models; this issue was raised numerous times during the press conference and presents a challenge to the central bank’s credibility, in our view.

Rufaro Chiriseri is the head of fixed income for the British Isles at RBC Wealth Management

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

RBC Wealth Management