In their Q4 2022 results announcements, Singapore’s major banks revealed that their revenue was negatively impacted by low wealth management fees – thus causing lower-than-expected profits. Looking ahead to 2023, GlobalData sees limited growth in risk-on investments, keeping wealth management fee income depressed despite rising assets under management (AuM).

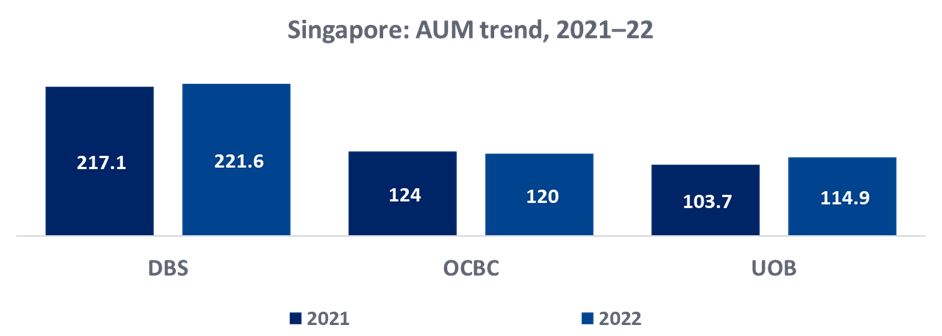

Singaporean banking giants DBS, OCBC, and UOB all reported lower wealth management fee income in Q4 2022. This was despite DBS and UOB recording higher client AuM in 2022 compared to 2021, while OCBC reported record net inflows.

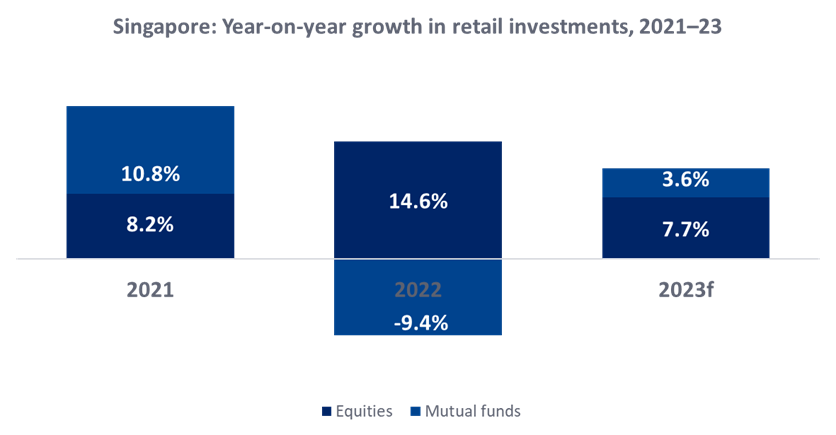

Subdued investment activity and risk-shy clients were cited as reasons for the decline. Unfortunately, these conditions are expected to continue well into 2023. Heightened geopolitical tension and weak global economic conditions will keep investor confidence muted – particularly for internationally connected hubs such as Singapore. Singaporean retail investment balances for equities and mutual funds will record growth of 7.7% and 3.6% respectively in 2023, which will not lead to a significant increase in fee income for wealth managers.

Moreover, growing competition from low-cost digital providers such as robo-advisors and online brokers will keep pressure on fee income. As of 2022, 21% of mass affluent investors in Singapore had used a robo-advisor to invest as per GlobalData’s Investor Insights: Channel Selection Analytics.

Despite a relatively healthy wealth market overall, increased competition, cautious investors, and anemic growth in retail equities and mutual funds will prevent Singapore’s banks from seeing a return to fast-growing wealth management income in 2023. Banks will need to be a little more patient with their wealth management divisions over the next 12 months.