A flurry of activity, to the surprise of many, has returned in China. Public transit ridership and airline travel are increasing, coinciding with lower COVID-19 cases. As the momentum continues, we think benefits for the global economy and select equities will emerge. Jasmine Duan, investment strategist at RBC Wealth Management, writes

Three months have passed since China’s zero-COVID policy pivot. The latest COVID-19 wave seems to have ended, and the warnings of global health organisations about massive infections during the Chinese New Year turned out to be unjustified. Investors are no longer asking whether the reopening is going to reverse; instead, they want to know what is happening on the ground and whether the reopening will boost domestic and global economic activity.

January and February are usually “data vacuum” periods in China. To avoid seasonal fluctuations due to the Chinese New Year, the Chinese government combines two months of data and announces them in March. Therefore, we leverage findings from our RBC Elements™ in-house data science team to examine the path towards normalisation and its implications for China and global equity markets.

New COVID-19 wave unlikely anytime soon

The number of COVID-19 cases in China reached a peak on Dec. 22, 2022, and has been trending down since then, was the message delivered by Wu Zunyou, chief epidemiologist at the Chinese Center for Disease Control, at an early February conference. He added that it is unlikely the country will experience another wave of infections in the coming months as the population’s immunity level is at its highest after recoveries from the previous wave.

His announcement coincides with our observations. People with friends and family in China may have noticed that after the large number of infections in December, they seldom hear anyone say they “caught COVID” recently. People have started to return to work, travel, and gather with friends and family without concerns. In other words, we think the mental hurdle of “catching COVID” is behind China.

Strong mobility rebound even after Chinese New Year

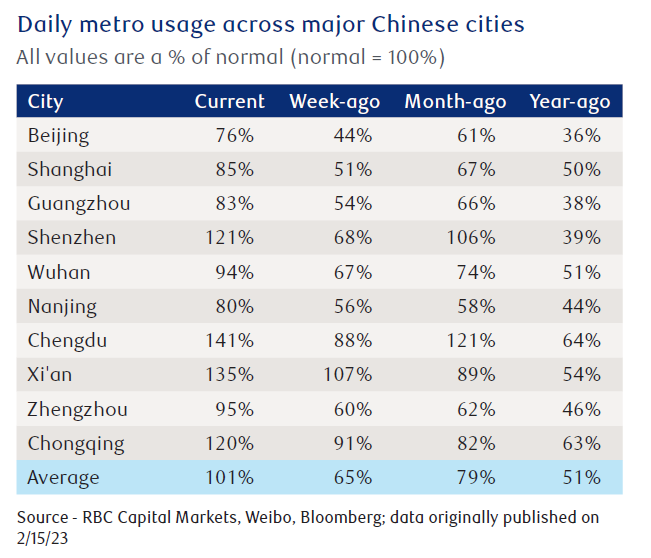

RBC Elements’ mobility data indicates the peak of COVID-19 has passed as daily metro ridership in major cities has picked up strongly since late December. The data also shows that the recovery trend continues after the Chinese New Year.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataPublic transit ridership is at 76% to 141% of pre-pandemic normal levels in 10 of the major Chinese cities RBC Elements tracked. The average is 101% with four of the major cities well above that level, including Shenzhen and Chengdu which have populations above 17 and 21 million people, respectively.

A surge in travel inquiries

As RBC Elements analysed data from Chinese internet search engines, the team discovered that travel keyword and then “rallied in parabolic fashion.” RBC Elements explained, “The recent eruption of searches directly follows Lunar New Year.”

Chinese flights are also rebounding, with total flight counts recovering to 80 percent of normal levels. RBC Elements expects the normalisation trend to continue in the next few months and the aggregate flight activity for the whole year “is on track to clock in at 5.2% above 2019 levels.”

Consumption likely tied to income expectations

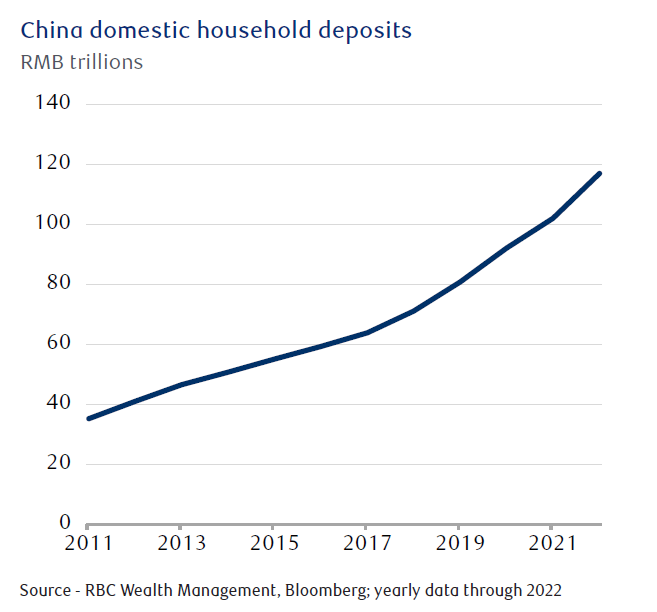

Market participants are debating the degree to which Chinese households will spend their record-high excess savings.

The People’s Bank of China recently disclosed that Chinese household savings surged by RMB17.8trn ($2.6trn) last year. We think economic uncertainty will likely lead Chinese households to maintain an elevated level of precautionary savings. But the key determining factors of consumption patterns should be peoples’ expectations about future income prospects, in our view.

According to a survey conducted by Zhilian Zhaopin, a major Chinese employment recruitment company, in the four-week period after the Chinese New Year, hiring demand continued to improve sequentially without showing signs of peaking. By sector, transportation/driver, tourism, and restaurant/catering are among the top five in hiring demand growth, up 55%, 50%, and 40% month over month, respectively, in the first month after the Chinese New Year.

We believe excess savings will be released gradually in H2 2023 as the economy recovers.

What to expect

The National People’s Congress is scheduled for March 5. We think it will be one of the most important meetings in China this year, as the agenda includes appointing new government officials and announcing a new economic growth target.

Importantly, we expect more pro-growth policies and further measures to support consumption to be announced after the Congress. These measures, combined with the release of excess savings, should

boost consumer spending and drive growth this year, in our assessment.

Consumption will play an important role for the country’s economic recovery especially because export prospects are uncertain and property development is slowing. China’s private consumption as percentage of GDP increased to nearly 40 percent in 2019 from around 35 percent in 2011, but is still much lower than 60 percent global average, according to International Monetary Fund (IMF) data. We think there is further room for consumption to grow as a share of the economy not only over the near term, but over the medium to longer term as well.

With the reopening progressing, RBC Global Asset Management’s Chief Economist Eric Lascelles recently upgraded his 2023 China GDP growth forecast to 5.3 percent from 4.4 percent. China’s recovery should be good news for the global economy as well, especially given the U.S. and Europe are expected to deliver below average growth. Lascelles’ GDP growth forecasts for the US and eurozone stand at 0.1 percent and -0.2 percent, respectively, for the full year. The IMF expects the Chinese economy to contribute a third of global growth in 2023.

Equity market implications

In our view, the reopening is not only gaining momentum, but is also coming in at a faster pace than most global equity market participants and economists expected a month or two ago. The latest released February China purchasing managers’ index surprised to the upside and, we believe, indicates a strong recovery.

The path towards economic normalisation should support Chinese corporates’ earnings growth and further market upside. The market has rallied meaningfully since November 2022. Even after the recent correction, the MSCI China Index is around 36 percent above its autumn low and has outperformed developed markets. Yet despite the rally, we think many investors haven’t fully realised how strong the reopening can be, and in our view the market’s valuation still seems attractive. It is trading at a price-toearnings ratio of 10.6x the 12-month forward consensus estimate, lower than the 12.2x five-year average.

China’s reopening should also benefit other economies, e.g., popular Chinese tourist destinations or countries that are natural resources exporters. Therefore, we think another option is to gain exposure to China indirectly by investing in the Asia region as a whole or in multinational companies headquartered in North America or Europe that have meaningful revenues in China. We think such stocks should also benefit from China’s reopening.

Related Company Profiles

RBC Wealth Management