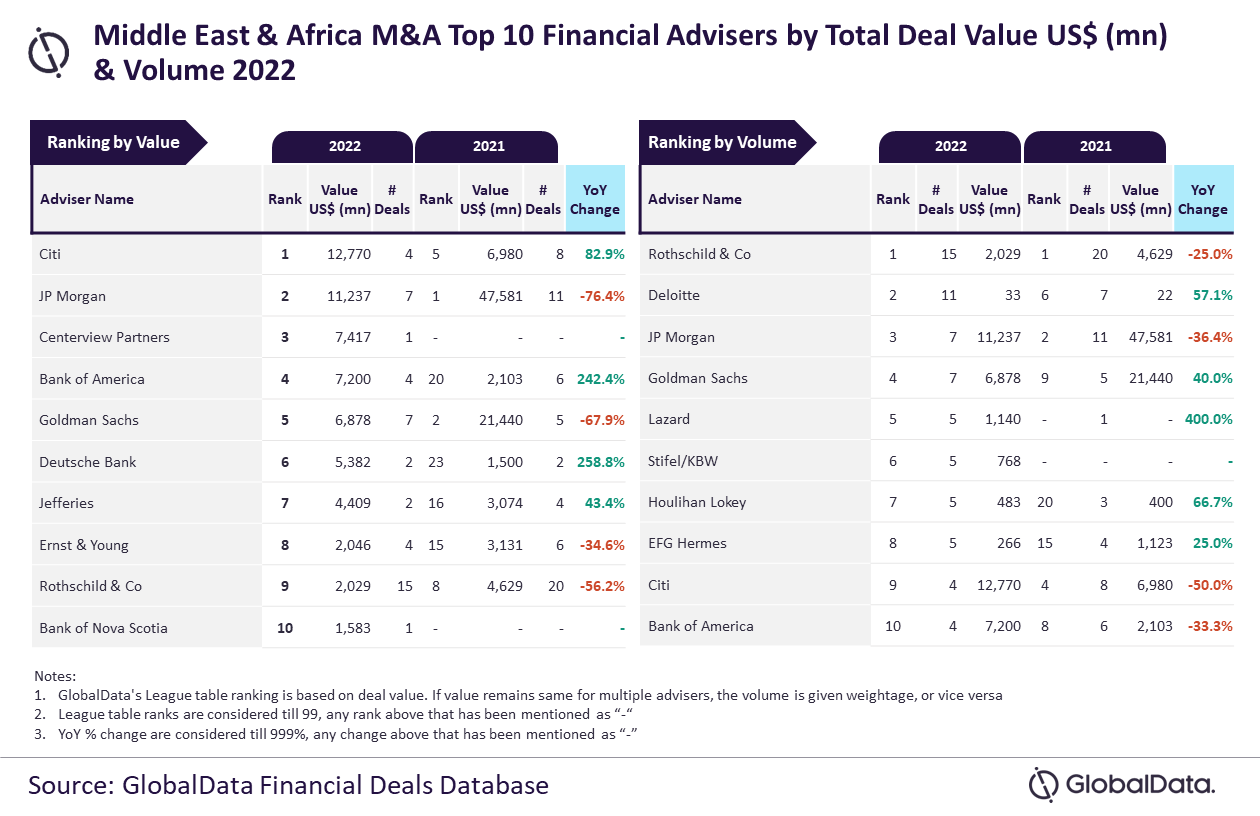

GlobalData, a leading data and analytics company, has revealed its league tables for top ten financial advisers by value and volume in Middle East and Africa for 2022.

Citi and Rothschild & Co were the top M&A financial advisers in the region during the period by value and volume, respectively.

Citi advised on $12.8bn worth of deals, while Rothschild & Co advised on a total of 15 deals.

GlobalData lead analyst Aurojyoti Bose said: “Although there was a decline in the number of deals advised by Citi, the total value of these deals were much higher (grew by a massive 82.9%) in 2022 compared to 2021. Resultantly, there was a significant jump in Citi’s ranking by value from the fifth position in 2021 to top of the chart in 2022.

“Meanwhile, Rothschild & Co, which was the top adviser by deals volume in 2021, managed to retain its lead in 2022 as well, despite suffering a decline in the number of deals.”

As per GlobalData’s financial deals database, JP Morgan took the second spot in terms of value, by advising on $11.2bn worth of deals; followed by Centerview Partners with $7.4bn; Bank of America with $7.2bn; and Goldman Sachs with $6.9bn.

In terms of volume, Deloitte got the second place with 11 deals; followed by JP Morgan with seven deals; Goldman Sachs with seven deals; and Lazard with five deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.