GlobalData, a leading data and analytics company, has revealed its league tables for top 10 financial and legal advisers by value and volume in Middle East and Africa for Q1 2022.

A total of 293 mergers and acquisitions (M&A) deals worth $24.8 billion were announced in the region during Q1 2022.

Top financial advisers by value and volume

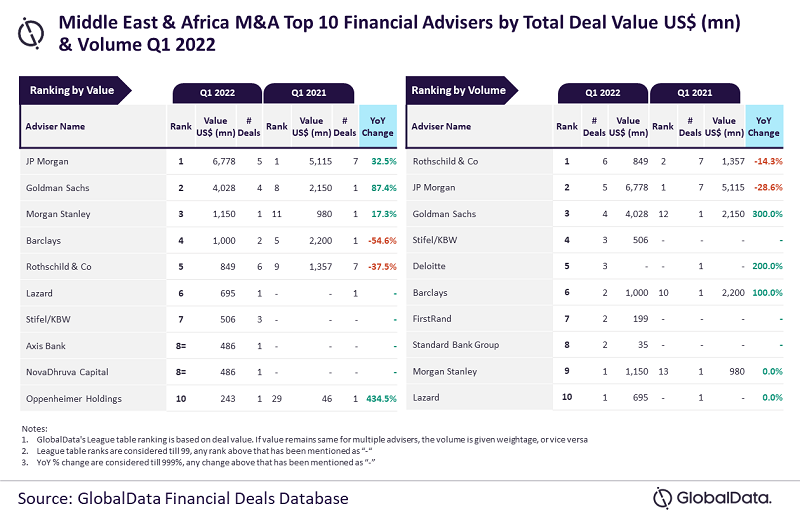

According to GlobalData’s ‘Global and Middle East & Africa M&A Report Financial Adviser League Tables Q1 2022’, JP Morgan and Rothschild & Co were the top M&A financial advisers in the Middle East and Africa region for Q1 2022 by value and volume, respectively.

Based on GlobalData’s Financial Deals Database, JP Morgan secured the top rank by value by advising on deals worth $6.8bn, while Rothschild & Co led the volume table by having advised on six deals.

GlobalData lead analyst Aurojyoti Bose said: “JP Morgan was among a small number of advisers that managed to touch the $1 billion mark in total deal value. In fact, it was the only adviser to surpass the $5 billion mark due to its involvement in Intel’s acquisition of Tower Semiconductor for $5.4 billion in February 2022.

“JP Morgan, apart from leading by value, also occupied the second position by volume. Similarly, Rothschild & Co, which led by volume, occupied the fifth position by value.”

The other high rankers by value included Goldman Sachs, with $4bn worth of deals; followed by Morgan Stanley, with $1.2bn; Barclays, with $1bn; and Rothschild & Co, with $849m.

In terms of volume, JP Morgan got the second spot with five deals; followed by Goldman Sachs, with four deals; Stifel/KBW, with three deals; and Deloitte, with three deals.

Top legal advisers by value and volume

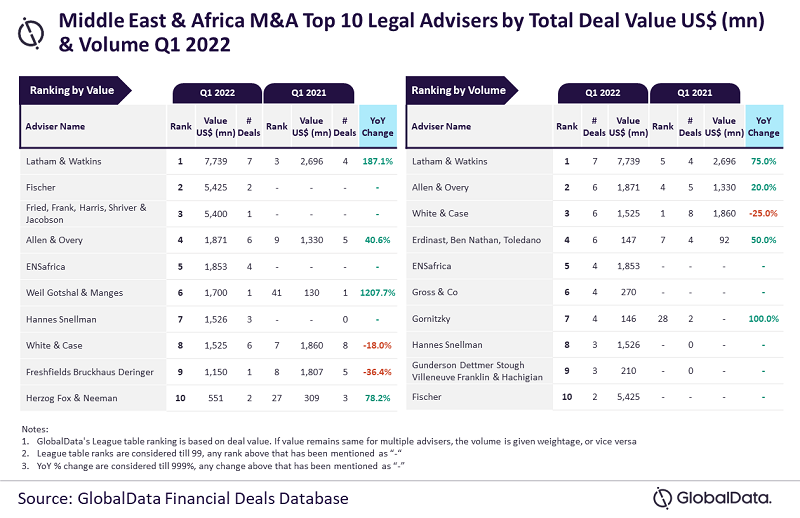

Latham & Watkins has emerged as the top M&A legal adviser in the Middle East and Africa region for Q1 2022, by both deal value and volume. Latham & Watkins gained its leading position by advising on seven deals worth $7.7bn, according to GlobalData’s ‘Global and Middle East & Africa M&A Report Legal Adviser League Tables Q1 2022’

GlobalData lead analyst Aurojyoti Bose said: “Latham & Watkins faced some competition in terms of volume, however, it surged ahead by value due to five of the seven deals it advised on being worth more than $100m. Of these five deals, one deal was also valued more than $5bn.”

The other high rankers by value include Fischer, with $5.42bn worth of deals; followed by Fried, Frank, Harris, Shriver & Jacobson, with $5.40bn; Allen & Overy, with $1.9bn; and ENSafrica, with $1.9bn.

In terms of volume, Allen & Overy got the second spot, with six deals; followed by White & Case, with six deals; Erdinast, Ben Nathan, Toledano with six deals; and ENSafrica, with four deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.